One Step Forward or One Step Back?

A Look at the Stamp Duties (Agreements for Sale of Equity Interests) (Remission) Rules 2018

The Stamp Duties (Agreements for Sale of Equity Interests) (Remission) Rules 2018 (2018 Rules) came into operation on 11 April 2018. The 2018 Rules provide for three class remissions: the remission of stamp duty on agreements for the sale of stock or shares not subject to the Additional Conveyance Duty (ACD); the remission of stamp duty on agreements for the sale of book-entry securities subject to ACD; and the remission of stamp duty for aborted agreements. This article examines the effects of the class remissions introduced by the 2018 Rules and how they interact with the amendments promulgated by the Stamp Duties (Amendment) Bill 2017.

Executive Summary

Just over a year after the Stamp Duties (Amendment) Bill 2017 (2017 Amendment Bill) was passed, the Stamp Duties (Agreements for Sale of Equity Interests) (Remission) Rules 2018 (2018 Rules) came into operation on 11 April 2018.

The 2017 Amendment Bill had introduced the Additional Conveyance Duty (ACD), a new duty that was designed to eradicate the stamp duty rate differential between instruments relating to the direct acquisition of residential property and instruments relating to their indirect acquisition through residential property-holding entities.

In addition to a full suite of new provisions specific to the ACD, the 2017 Amendment Bill also included amendments to existing provisions of the Stamp Duties Act (Cap 312) to accommodate this objective. In particular, Section 22(1)(b) of the Stamp Duties Act was amended to remove four words — “and stocks or shares” — from the scope of the specific exceptions to dutiable contracts or agreements.

The deletion of the four words “and stocks or shares” in Section 22(1)(b) of the Stamp Duties Act resulted in a seismic shift in the principle and practice underpinning the stamping of instruments relating to stocks and shares. Literally overnight, the duty point for all transfers of stocks and shares was shifted forward from the execution of the share transfer form to the execution of the contract or agreement for the sale of the shares.

In the aftermath of the 2017 Amendments, the 2018 Rules were promulgated by the Minister for Finance (Minister) under Section 74 of the Stamp Duties Act. The 2018 Rules provide for the following class remissions:

- The remission of stamp duty on agreements for the sale of stock or shares not subject to ACD;

- The remission of stamp duty on agreements for the sale of book-entry securities subject to ACD; and

- The remission of stamp duty for aborted agreements.

This article examines the effects of the amendments introduced by the 2017 Amendment Bill on documents relating to the sale of equity interests, and how the class remissions introduced by the 2018 Rules addressed those concerns.

The 2017 Stamp Duty (Amendment) Bill

On 10 March 2017, the 2017 Amendment Bill was passed into law after having its three readings done in a single Parliament sitting and came into effect the next day. The 2017 Amendment Bill was passed as an urgent bill as the measures involved were market-sensitive.1 Official Reports of the Singapore Parliamentary Debates, Vol 94, Sitting No 43, Second Reading of the Stamp Duties (Amendment) Bill 2017 by the Second Minister for Finance (Mr Lawrence Wong), 10 March 2017. Primarily, the 2017 Amendment Bill introduced ACD, a new ad valorem stamp duty treatment for the acquisition and disposal of equity interests in property holding entities (PHEs) that are computed on the basis of their underlying immovable residential properties.

The purpose for the new stamp duty treatment was to address the stamp duty rate differential that existed between the direct acquisition or disposal of residential properties in Singapore and the acquisition or disposal of equity interests in entities whose primary tangible assets were residential properties in Singapore.2 Official Reports of the Singapore Parliamentary Debates, Vol 94, Sitting No 43, Second Reading of the Stamp Duties (Amendment) Bill 2017 by the Second Minister for Finance (Mr Lawrence Wong), 10 March 2017. Prior to the amendments, the stamp duty rates were as follows:

| Stamp Duty Rates3 Based on the higher of the purchase price or the value of the asset transferred.: Pre-2017 Amendments | |||

| Event | Asset | ||

| Residential property | Stocks or shares | Interests in other entities (e.g. partnerships) and in trusts | |

| Acquisition | Buyer’s Stamp Duty: 1 – 3%

Additional Buyer’s Stamp Duty: Up to 15% |

0.2%4 This treatment applied even when the entity’s assets comprised mainly of residential properties in Singapore. | N.A.5Ibid. |

| Disposal | Seller’s Stamp Duty: Up to 16% | N.A.6Ibid. | N.A.7Ibid. |

In addition to a full suite of new provisions specific to the ACD, the 2017 Amendment Bill also included amendments to existing provisions of the Stamp Duties Act to accommodate its objective. One of the amendments was the removal of four words — “and stocks or shares” — from the scope of the specific exceptions to dutiable contracts or agreements under Section 22(1)(b) of the Stamp Duties Act. According to the explanatory statement to the 2017 Amendment Bill, the removal was to clarify that contracts or agreements for the sale of stocks and shares would be dutiable going forward.8 Explanatory statement of the 2017 Amendment Bill, at Clause 5, page 30.

The amendment to Section 22(1)(b) aligned the duty point for transfers of stocks or shares with the duty point for transfers of real property, from the transfer stage to the contract stage. By virtue of Section 22(1), stamp duties applicable to a sale and purchase of real property in Singapore are chargeable on the executed contract or agreement, as if such contract or agreement was a conveyance on sale. The subsequent transfer instrument executed at completion is not required to be stamped. In contrast, prior to the amendments, the long-settled position with respect to the sale and purchase of shares was that stamp duty was not chargeable on the contract or agreement but on the share transfer form executed at completion, which transferred title from vendor to purchaser. This was because of the proviso within Section 22(1)(b), which specifically exempted, inter alia, contracts or agreements for stock or shares from the scope of Section 22(1). As a result of the amendment to Section 22(1)(b), which removed contracts or agreements for stock or shares from the said proviso, the duty point for all share transfers was shifted forward from the execution of the share transfer form to the execution of the contract or agreement for the sale of the shares.

Although the intention underpinning the amendment to Section 22(1)(b) was to enable the implementation of the ACD regime, its effect went beyond that scope and affected the stamp duty treatment for all share transfers, whether the underlying company held residential property or not.

The Law Society Feedback

During the second reading of the 2017 Amendment Bill, the Second Minister for Finance, Lawrence Wong, recognised that the Government would have to monitor the way industry players responded to the changes promulgated. Given the market sensitive nature of the new tax treatment, a public consultation prior to its enactment was out of the question. In the absence of a public consultation exercise for the changes enacted under the 2017 Amendment Bill, market feedback could only be reactive in nature.

After the 2017 Amendment Bill was passed, the Corporate Practice Committee of the Law Society (Corporate Practice Committee) initiated discussions with representatives of the Inland Revenue Authority of Singapore (IRAS) and the Ministry of Finance to provide feedback on the amendments to Section 22(1)(b) of the Stamp Duties Act. During the discussions, the following issues were highlighted by the Corporate Practice Committee:

- First, the amendment to Section 22(1) impacted all transfers of shares in Singapore companies, with neither distinction between private and listed companies; nor between PHEs9 See definition of “PHE”, Section 23(13) of the Act: and non-PHEs. As a consequence, uncertainty arose for certain documents relating to scripless shares, such as the Form of Acceptance and Authorisation (FAA). The FAA is a standard document issued by an offeror in the context of a general offer made for the shares of a Singapore listed company. A shareholder who wanted to accept the general offer would indicate his acceptance by signing the FAA and delivering it to the Central Depository (Pte) Limited (CDP) to be processed. While the practice before 11 March 2017 was not to stamp these FAAs, it became uncertain whether the FAAs may be regarded under the new language of Section 22(1) as dutiable contracts or agreements, which would be subject to stamp duty. Similarly, in the case of a shareholder who executes a prescribed CDP form to authorise the debit and/or credit of scripless shares from/to his CDP account, it also became uncertain if such a CDP form would constitute a dutiable contract or agreement for shares.

- Second, the advancement of the duty point for share transfers produced practical disadvantages which were non-conducive to commerce. The liability to pay stamp duty would occur at an earlier stage of the transaction, even though the contract or agreement may be subject to various preconditions to completion that may never be fulfilled such that legal title to the shares may later not take place. Stamp duties paid when entering the contract or agreement for the sales of shares would be subject to the risk that the transaction may be aborted before the transfer. Further, there was no clear remission framework within the Stamp Duties Act for contracts or agreements for shares that were later rescinded or annulled on grounds other than that which was provided under Section 22(6) (ie, vendor is unable to prove his title to the stocks or shares).

- Third, the forward shift of the duty point from the transfer stage to the contract stage created potential cash-flow financing issues where the stamp duty amount was substantial. Obtaining third-party financing was problematic as the banks may not be prepared to provide financing without legal title to the shares, which could only be transferred at completion. Furthermore, from a valuation perspective, it was impossible in many cases to determine the precise amount of stamp duty payable at the time it was due. This was because the actual value of the consideration would typically be determined upon completion, based on an agreed formula, and not at the time of signing.

The 2018 Rules

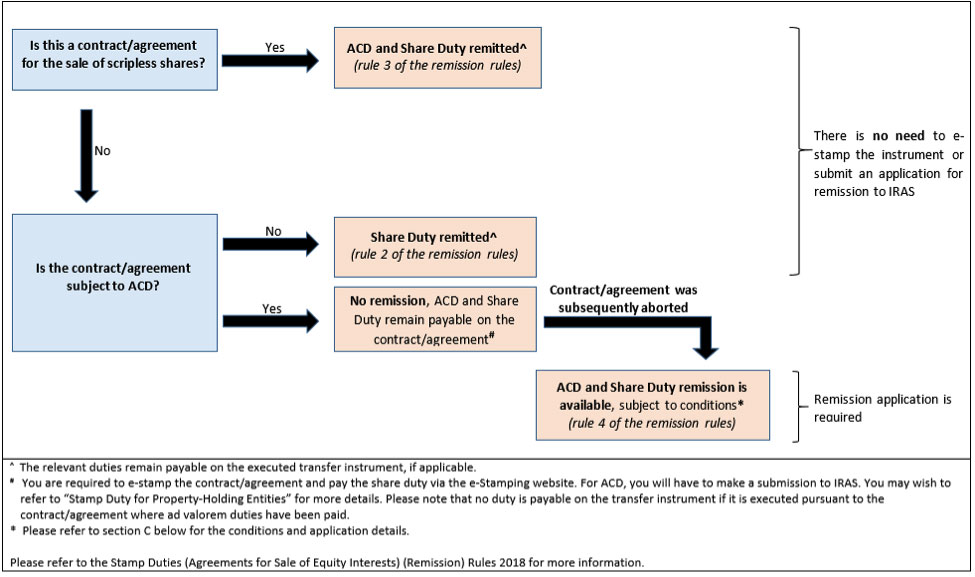

The 2018 Rules came into effect on 11 April 2018, providing much welcomed clarity on the issues enumerated above. The 2018 Rules provide for the following class remissions:

- Rule 2: Remission of stamp duty on agreements for the sale of stock or shares not subject to ACD;

- Rule 3: Remission of stamp duty on agreements for the sale of book-entry securities subject to ACD; and

- Rule 4: Remission of stamp duty for aborted agreements.

Rule 2: Remission of Stamp Duty on Agreements for the Sale of Stock or Shares not Subject to ACD

Rule 2 remits any ad valorem duty chargeable under Article 3(c) of the First Schedule to the Stamp Duties Act on the contract or agreement by reason of Section 22(1) of the Stamp Duties Act, provided that the contract or agreement does not relate to any stock or shares, or any interest in any stock or shares, that is subject to ACD.

Rule 2 resolves many of the issues highlighted by the Corporate Practice Committee:

- First, it distinguishes between share transfers relating to PHEs and those relating to non-PHEs, thus refining the ACD framework such that it captures only contracts or agreements within its intended ambit.

- Second, it reverts the duty point for all non-PHE related share transfers from the contract execution stage to the transfer stage. Therefore, the liability to pay ad valorem duty chargeable under Article 3(c) of the First Schedule to the Stamp Duties Act would only arise upon the execution of the transfer instrument (i.e. the share transfer form), which would typically happen at a later stage in the transaction.

Notably, Rule 2 would extend also to any share transfer for scripless shares that does not relate to a PHE. It removes any uncertainty over the stamp duty treatment for documents relating to scripless shares, such as the FAA. Thus, if no share transfer form is executed for the transfer of such scripless shares, no stamp duty would be levied.

Rule 3: Remission of Stamp Duty on Agreements for the Sale of Book-Entry Securities Subject to ACD

Rule 3 applies to a contract or agreement for the sale of any scripless shares that is subject to ACD.10 Rule 3(1) of the 2018 Rules. Rule 3(2) remits (i) any ad valorem duty chargeable under Article 3(c) of the First Schedule to the Stamp Duties Act on such contract or agreement by reason of Section 22(1) of the Stamp Duties Act; and (ii) any ACD chargeable on such contract or agreement.

Rule 3 provides investors with much sought certainty that they would not be subject to ACD on the buying and selling of scripless shares, by giving legislative effect to the assurance from the Minister during the second reading of the 2017 Amendment Bill that “[ACD] will not impact the ordinary buying and selling of shares by retail investors in entities listed on Singapore Stock Exchange. Currently, they are not subject to share duties where the shares are scripless and no document is executed for the transfer of such shares. Rather, the ACD is aimed at the transfer of equity interest in [PHEs] by significant owners of such entities.”11Supra at Note 2.

Rule 4: Remission of Stamp Duty for Aborted Agreements

Rule 4 applies to a contract or agreement for the sale of equity interests in an entity executed on or after 11 March 2017 where, (i) the contract or agreement is rescinded or annulled; and (ii) the purchaser did not procure the rescission or annulment with a view to facilitating the disposition of the equity interests by the vendor to another person.12 Rule 4(1) of the 2018 Rules.

Under Rule 4(2), (i) any ad valorem duty (in excess of $50) chargeable under Article 3(c) of the First Schedule to the Stamp Duties Act on such contract or agreement by reason of Section 22(1) of the Stamp Duties Act is remitted; and (ii) any ACD (in excess of $50) chargeable on such contract or agreement is also remitted, if the statutory requirements are met.13 Rule 4(3) of the 2018 Rules. These statutory requirements are:

- The person who paid or is liable to pay the duty must provide such evidence of the rescission or annulment as may be required by the Commissioner of Stamp Duties within six months of the date of such rescission or annulment;14 Such longer period as the Commissioner considers reasonable may be permitted, if the evidence cannot be provided within the period in sub‑paragraph 20(i) because of unavoidable circumstances: Rule 4(3)(ii) of the 2018 Rules. and

- The contract or agreement is to be surrendered for cancellation within the six months period mentioned above, unless the Commissioner of Stamp Duties dispenses with the surrender in a particular case or the instrument has already been surrendered for cancellation in relation to an earlier remission under this Rule 4.

Rule 4 addresses the concern about the lack of a clear remission framework for aborted contracts or agreements relating to shares. Certainly, it is an improvement from the previous position, where Section 22(6) only offered limited basis for the refund of stamp duty for an aborted contract or agreement for shares.

Procedural Considerations

The 2018 Rules was certainly legislated to work pragmatically. To minimise the compliance burden on taxpayers, the class remissions under Rules 2 and 3 apply automatically, without any application to or prior approval of the IRAS.

The remission under Rule 4, however, would be granted upon application, on a case-by-case basis. This is because Rule 4 requires certain supporting documents to be produced to determine if the statutory requirements are met.

A diagrammatic summary of the application of the 2018 Rules is provided by the IRAS15 Accessed on 10 June 2018: https://www.iras.gov.sg/irashome/Other-Taxes/Stamp-Duty-for-Shares/Claiming-Refunds-Remissions-Reliefs/Reliefs/Agreements-for-Sale-of-Equity-Interests/ and reproduced below:

Concluding Remarks

As discussed above, the amendment in 2017 to Section 22(1)(b) of the Stamp Duties Act had an impact that extended beyond the intended scope of achieving stamp duty neutrality between the buying or selling of residential properties and the buying or selling of equity interest in entities holding residential properties. As a result, the past year presented new challenges for parties involved in any share transfer. The enactment of the 2018 Rules is, therefore, much welcomed. Working in tandem with the amendments introduced by the 2017 Amendment Bill, the 2018 Rules restores much of the operational benefits of the stamp duty regime applicable to a share transfer prior to the 2017 Amendment Bill. In addition, it has expanded the remission framework of aborted contracts or agreements for shares. Overall, the 2018 Rules was the crucial last piece that completes the ACD regime in a manner that enables its objective of stamp duty neutrality to be met with enhanced precision and discernment.

Endnotes

| ↑1 | Official Reports of the Singapore Parliamentary Debates, Vol 94, Sitting No 43, Second Reading of the Stamp Duties (Amendment) Bill 2017 by the Second Minister for Finance (Mr Lawrence Wong), 10 March 2017. |

|---|---|

| ↑2 | Official Reports of the Singapore Parliamentary Debates, Vol 94, Sitting No 43, Second Reading of the Stamp Duties (Amendment) Bill 2017 by the Second Minister for Finance (Mr Lawrence Wong), 10 March 2017. |

| ↑3 | Based on the higher of the purchase price or the value of the asset transferred. |

| ↑4 | This treatment applied even when the entity’s assets comprised mainly of residential properties in Singapore. |

| ↑5 | Ibid. |

| ↑6 | Ibid. |

| ↑7 | Ibid. |

| ↑8 | Explanatory statement of the 2017 Amendment Bill, at Clause 5, page 30. |

| ↑9 | See definition of “PHE”, Section 23(13) of the Act: |

| ↑10 | Rule 3(1) of the 2018 Rules. |

| ↑11 | Supra at Note 2. |

| ↑12 | Rule 4(1) of the 2018 Rules. |

| ↑13 | Rule 4(3) of the 2018 Rules. |

| ↑14 | Such longer period as the Commissioner considers reasonable may be permitted, if the evidence cannot be provided within the period in sub‑paragraph 20(i) because of unavoidable circumstances: Rule 4(3)(ii) of the 2018 Rules. |

| ↑15 | Accessed on 10 June 2018: https://www.iras.gov.sg/irashome/Other-Taxes/Stamp-Duty-for-Shares/Claiming-Refunds-Remissions-Reliefs/Reliefs/Agreements-for-Sale-of-Equity-Interests/ |