Out at Sea: Poseidon Principles and its Applicability and Relevancy in Loans

This article will explore and discuss Poseidon Principles and its applicability and relevancy in loan agreements. With the exponential emphasis on green finance and sustainable finance, these Principles will be increasingly relevant.

What are Poseidon Principles?

Poseidon Principles (Principles) are an international framework for assessing and disclosing the climate alignment of financial institutions’ shipping portfolios.

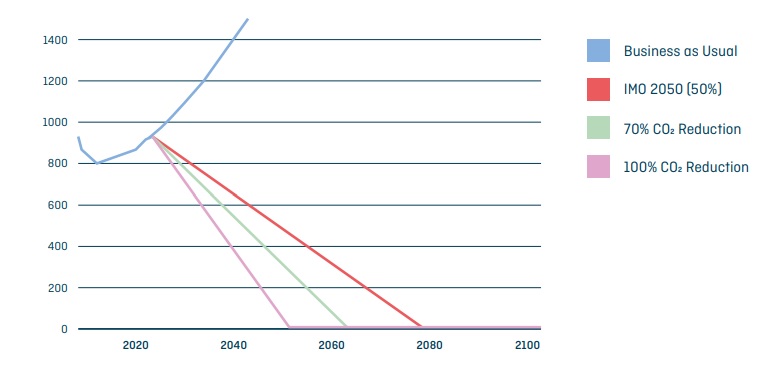

They establish a common baseline to quantitatively assess and disclose whether financial institutions’ lending portfolios are in line with adopted climate goals, which is to reduce the total annual greenhouse gas emissions by at least 50 per cent, as set out in figure 1.1Poseidon Principles: A global framework for responsible ship finance (Version 4.2, April 2023) https://www.poseidonprinciples.org/finance/wp-content/uploads/2022/12/Poseidon-Principles-Annual-Disclosure-Report-2022.pdf

In a nutshell, these are the four Principles: (i) annual measurement of the carbon intensity and assessment of climate alignment of the signatories’ shipping portfolios using the methodology established by the Principles; (ii) reliance on classification societies or other International Maritime Organisation (IMO) recognised organisations, and compulsory standards established by the IMO, to provide information used to assess and report on climate alignment; (iii) use of standardised covenant clauses in new business activities to calculate carbon intensity and climate alignment; and (iv) publishing of portfolio climate alignment scores on an annual basis.2Poseidon Principles: A global framework for responsible ship finance (Version 4.2, April 2023) https://www.poseidonprinciples.org/finance/wp-content/uploads/2022/12/Poseidon-Principles-Annual-Disclosure-Report-2022.pdf

Figure 1

Who are the Signatories?

Signatories commit to implementing the Principles in their internal policies, procedures, standards and to work with the clients on an ongoing basis to implement the Principles.

Currently, thirty (30) financial institutions, including BNP Paribas, Citigroup and ING Group, are signatories to the Principles. By way of comparison, other banks, such as JP Morgan Chase Bank and DBS Bank Ltd are not signatories to the Principles.3Signatories https://www.poseidonprinciples.org/finance/signatories/

While the Principles must be applied to all signatories to the Principles in the below mentioned business activities, they are not mandatory to those who are not signatories but nevertheless, participants in the loan facilities.

Business Activities include the following: (i) credit products, including bilateral loans, syndicated loans, club deals and guarantees, secured by vessel mortgages or unmortgaged Export Credit Agency loans tied to a vessel; and (ii) where a vessel or vessels fall under the purview of IMO (vessels weighing 5,000 gross tonnage and above which have an established Principles trajectory whereby the carbon intensity can be measured with IMO data).4Poseidon Principles: A global framework for responsible ship finance (Version 4.2, April 2023) https://www.poseidonprinciples.org/finance/wp-content/uploads/2022/12/Poseidon-Principles-Annual-Disclosure-Report-2022.pdf

Applicability and Relevancy in Loan Agreements

As mentioned above, the Principles are not mandatory to lenders, relevant lessors, and financial guarantors who are not signatories5FAQs https://www.poseidonprinciples.org/finance/faqs/. Nevertheless, it is good practice for them to comply with these Principles. At times, they may be party to an agreement which has pledged to abide by the Principles.

By way of an example, a Bank, although not a signatory, may be party to a syndicated green loan in which other signatories commit to the Principles when carrying out the transaction.

Hence, if the Bank becomes party to the Facility Agreement in the capacity as a Lender, the courts will presume that the parties intend to be legally bound by the terms. To elaborate, there may be potential reporting obligations in connection with Target IMO Decarbonisation Trajectory or greenhouse gas emissions. Depending on parties commercial intentions, these reporting obligations can be a Default of Event of Default should parties not comply with them. Nevertheless, the presumption can be displaced where the parties declare the contrary intention.

The Sea Ahead

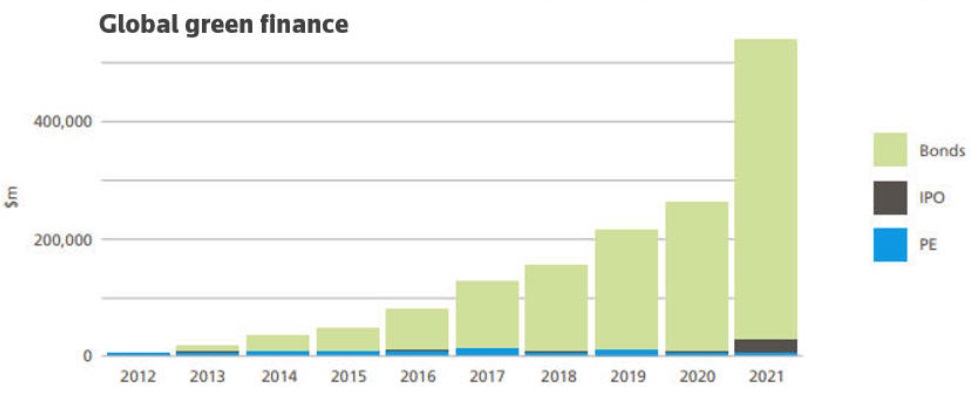

With the increasing emphasis on green finance and sustainable finance, with international borrowing swelling to $540.6 billion in 2021 from $5.2 billion in 2012, as illustrated in figure 2,6Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru, ‘Global green finance rises over 100 fold in the past decade -study’ Reuters (1 April 2022) https://www.reuters.com/business/sustainable-business/global-markets-greenfinance-graphics-2022-03-31/ these Principles will be increasingly relevant in the area of financing.

Figure 2

Endnotes