Budget 2023 – A Valentine’s Budget?

As Valentine’s day approaches every year, there will be the usual air of excitement (or anticipation) and for some, a sense of trepidation. This year was no different. Some wives would blame not receiving flowers on being married for many years or the rising costs of living in Singapore. Some husbands would resign themselves to spending exorbitant amounts on severely marked-up flowers. Luckily this year there was a lot of chatter about how the Government is giving vouchers and cash payouts to tackle the higher cost of living which became a very useful form of distraction.

Enterprise Innovation Scheme (EIS)

This is perhaps the most significant corporate scheme announced on a Valentine’s day. To encourage Singapore businesses to engage in R&D, innovation and capability development activities, this tax scheme will be introduced to allow tax deduction of 400% on qualifying activities for the next five years. In lieu of deductions, businesses can opt for a non-taxable cash payout conversion at 20% of up to $100,000 of spending.

I would not consider this scheme to be new but a resurrection of an old scheme since it is desperately similar to the Productivity and Innovation Credit (PIC) Scheme which shook certain sectors in years of assessment 2011 to 2018, such as the printing and IT software developers. Every small business had to upgrade their servers, laptops and copiers in order not to miss out on the lucrative cash payout.

Notwithstanding the similarities, it is unlikely to attract as much attention since the cash payout conversion rate during PIC years was as high as 60% and “acquisition and leasing of IT equipment” was no longer one of the qualifying expenditures this time round.

In my view, this exclusion is a good move since businesses are prone to overspend on IT hardware and software and our past experience showed that the Inland Revenue Authority of Singapore was not the best agency to handle grant applications and disbursements. Such grants should be left to agencies like Enterprise Singapore which are far better equipped with manpower resources to sort out the true needy applicants and those who might be abusing the scheme.

Extension of Various Schemes Due for Expiry

Besides the EIS, some extension of existing tax incentives schemes are worth a mention. According to the published Annex G-1 on tax changes, the following corporate schemes are given a longer lease of life:

- Investment Allowance Scheme till 31 December 2028 to make capital investments.

- Investment Allowance 100% Scheme for Automation till 31 March 2026.

- Pioneer Certificate Incentive Scheme and Development and Expansion Incentive Scheme till 31 December 2028 for high value-added manufacturing and services.

- IP Development Incentive till 31 December 2028 for commercialisation of IP.

- Qualifying Debt Securities Scheme till 31 December 2028.

- Financial Sector Incentive Scheme till 31 December 2028.

Other Tax Changes

Most of us would be drawn to the raising of buyer’s stamp duty rates for higher-value residential and non-residential properties or additional registration fee changes to make our homes and vehicles more expensive since such changes have an instant impact to the market and massively affects people’s purchase behaviours. It is easy to overlook the change in Working Mother’s Child Relief (WMCR) from a percentage-based relief to the fixed dollar tax relief, as one of the most significant non-corporate tax changes. Let me explain.

WMCR – One Full Circle

On the procreation front, Singapore’s total number of births per resident (that is, citizen or permanent resident) woman has fallen since 1980, hitting an all-time low of 1.26 in 2003. The then Deputy Prime Minister and Minister for Finance, Mr Lee Hsien Loong, delivered the FY2004 Budget Statement on 27 February 2004 and remarked, “while families should not have babies just because of financial incentives, tax reliefs and rebates for parents and working mothers appreciably lighten the financial burden of bringing up children, We need to … make them more accessible and attractive to couples”. In the following months, two civil service teams visited Europe to study how countries like Netherlands, France, Norway and Sweden succeeded in bringing their birth rates up. On 17 November 2004, Acting Second Minister for Finance, Raymond Lim, spoke at the reading speech on The Income Tax (Amendment) Bill 2004. With the key objective of encouraging more women to rejoin the workforce after having children, he introduced WMCR to replace the Enhanced Child Relief (ECR) Scheme.

Initially, the amount of relief that the mother could claim was 5% of her earned income for her first child, 15% for her second child, 20% for her third child and 25% for her fourth child. The Government removed the condition that the mother must have three GCE O Levels or equivalent qualifications to qualify for the WMCR, which was a condition for the ECR. The WMCR is only claimable by parents of Singapore Citizen children. For a qualifying Singapore Citizen child born or adopted before 1 January 2024, the WMCR cap has been enhanced over the years to $50,000 per child, and the amount of 15% for her first child, 20% for second and 25% for third and beyond. Noting that the total relief cap of $80,000 applicable to all tax payers with effect from year of assessment 2018, the single most attractive part to this scheme is the percentage component as it encourages women to strive for their careers and financial rewards since the reliefs are more generous the more the taxpayer earns.

As part of the current review of the Government’s support for Marriage & Parenthood, the WMCR percentage computation will be dropped in favour of a fixed dollar tax relief for eligible working mothers in respect of qualifying children who are Singapore Citizens born or adopted on or after 1 January 2024 (or year of assessment 2025).

Case illustration:

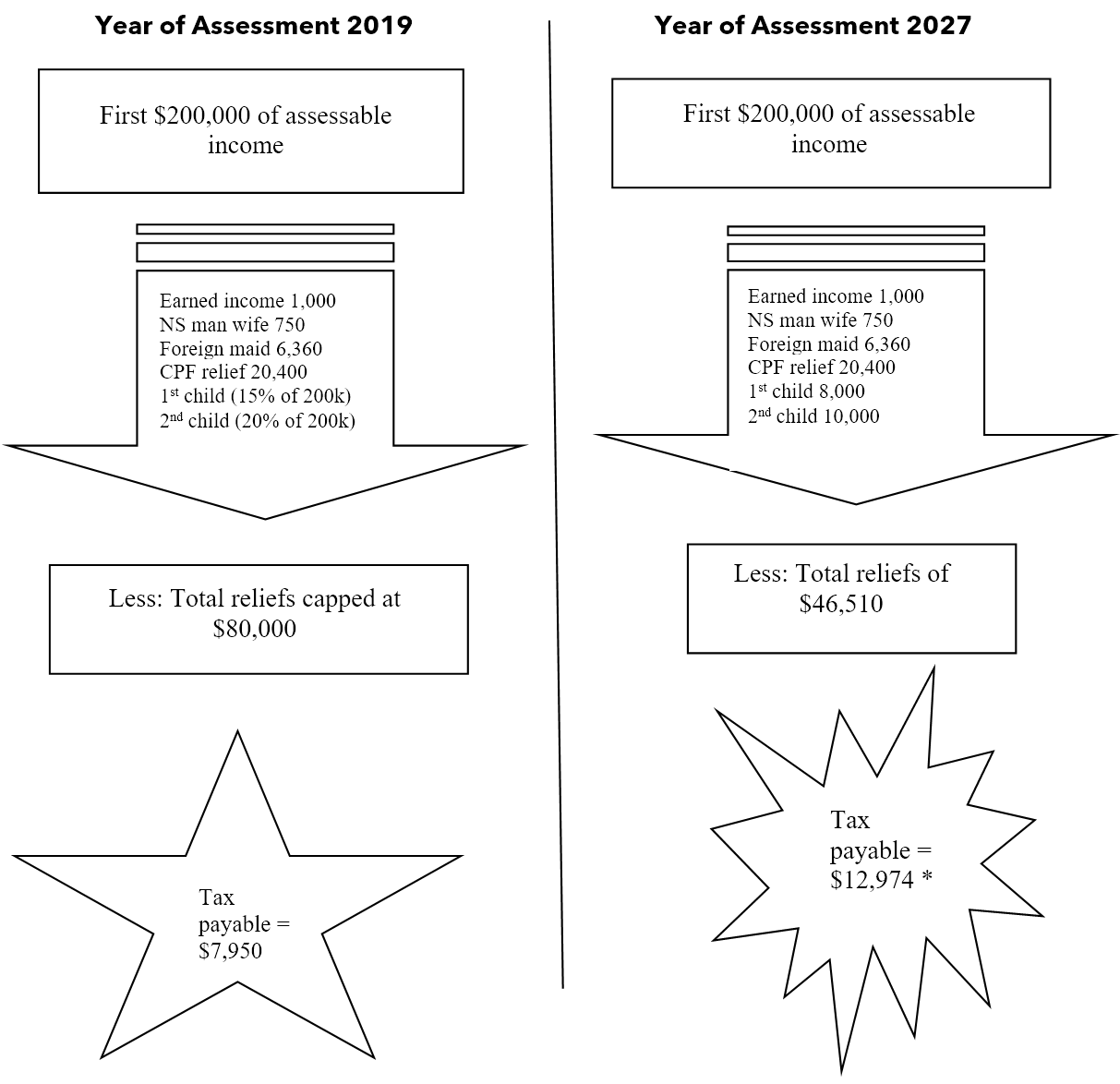

Ms Chai Toh is a lawyer with two children born before 1 January 2024, working in a mid-tiered law firm and earning an income of S$200,000 in the calendar year 2018. This calculation showed her income tax liability versus the scenario in the future if her children are born on and after 1 January 2024.

* Assuming no change in future income tax rates

Her additional tax liability = $5,024 [ $12,974 – $7,950]. The additional tax liabilities purported to the working mothers of the future is not just a single figure of $5,000 but one of a consolidated tax burden to her and the family as she is eligible to claim the same amount of WMCR for the next 20 plus years when her children are growing up, studying and not earning income exceeding $4,000 annually. Potentially, the additional tax liabilities could work out to be over $150,000 over the lifetime of supporting the children. Interestingly, the one-off baby bonus cash gift increase of $3,000 pales in comparison.

In reality, what is the right balance of tax reliefs for different families can differ greatly. What kind of statistics can be a good indicator of more births due to more attractive reliefs? With this change, the instant flavour is WMCR will no longer be attractive to the working women of tomorrow but its real impact to the procreation front could only be felt years later when both men and women together are making a life decision on whether it is too expensive to have children. So while I urge the Government to re-dress this in the next Budgets to come, we are unlikely to see any immediate favour.

Conclusion

It was two decades ago when the WMCR was introduced as an innovative and attractive scheme to strongly encourage Singapore working mothers to contribute to nation building. Given the current post-pandemic economic environment with higher costs of living, the Government has seemingly signaled its shift in position of encouraging childbirths by fixing the WMCR to a fixed small rate instead of percentage based. Although the change does indeed benefit a group of lower income working mothers, the quantum of benefit is negligible compared to the loss in tax savings felt by the higher earners’ group of women. Unfortunately, most women will only feel the pinch when they move up the corporate ladder and earn more.

For the fathers of tomorrow, it may be wise to cut down spending and stop sending the occasional flowers, and saying “my money is your money”. Perhaps as a gift on Valentine’s, change that tagline to “your taxes are my taxes”. That might do the trick.

Notes

- Second Reading Speech by Raymond Lim, Acting Second Minister For Finance on The Income Tax (Amendment) Bill 2004, at The Parliament, 17 Nov 2004

- Singapore Budget Statement 2004

- Singapore Budget Statement 2023