China Meets Digital Currency: E-CNY and Its Implications for Businesses

China is likely to be the first major economy to issue central bank digital currency (CBDC). China’s CBDC, e-CNY, may lead to a new ecosystem that would profoundly affect business, product offerings and business practice. E-CNY is likely to affect both local and international businesses, particularly those with a presence in China or those who commonly transact with Chinese actors. There is also the possibility of e-CNY use outside of China. If China’s CBDC practice and standards affect international practice (such as through standard making), e-CNY has the potential to affect the broader businesses community. This article discusses the following crucial questions: how to understand e-CNY? What does e-CNY mean for local and international businesses? Businesses need to adequately prepare for a new business landscape with e-CNY that is not only a currency but also generates large amounts of data.

Introduction

Central bank digital currency (CBDC), also known as sovereign digital currency and digital fiat currency, is the digital version of sovereign currency issued by an economy’s monetary authority.1John Kiff, et al., A Survey of Research on Retail Central Bank Digital Currency, IMF Working Paper No. 20/104, 5 (2020). The introduction of CBDCs and their technical designs will carry significant “policy and legal implications” for domestic and international businesses alike.2Yves Mersch, Yves Mersch: An ECB Digital Currency – a Flight of Fancy?(2020), available at https://www.bis.org/review/r200511a.pdf.

China’s CBDC is termed as e-CNY, digital yuan, digital RMB and digital CNY. E-CNY was also previously known as the Digital Currency/Electronic Payment (DC/EP or DCEP).3Changchun Mu, Digital Currency Institute of the People’s Bank of China, in Inthanon-LionRock to mBridge: Building a Multi CBDC Platform for International Payments 13, (BIS Innovation Hub Hong Kong Centre, et al. eds., 2021). DCEP is also used to refer to the payment network as a whole. China’s CBDC will be a cash-like liability of the central bank available to the public and foreign visitors.4Raphael Auer, et al., Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies, BIS Working Papers No 880, 6 (2020). China’s CBDC is not only a digital currency and an electronic payment instrument,5Yanting Wu, Why Does the Digital RMB Accelerate?, Outlook Weekly (2021). but a research and development project for the People’s Bank of China (PBOC), China’s central bank.6Xiaochuan Zhou, Understanding China’s Central Bank Digital Currency(2020), available at http://www.cf40.com/en/news_detail/11481.html.

Domestically, e-CNY is “likely to become an important feature of China’s digital economy and financial system”.7David Olsson, et al., China’s Digital RMB – Is Your Business Ready?(2021), available at https://www.kwm.com/en/au/knowledge/insights/chinas-digital-rmb-is-your-business-ready-20210427. Like physical RMB, e-CNY is the legal tender in China issued by the PBOC. It contrasts with private cryptocurrencies like Bitcoin and Diem (previously known as Libra), which can be rejected as a form of payment.8Jiaying Jiang & Karman Lucero, Background and Implications of China’s E-CNY, 2 (2021). China’s CBDC is intended to be “mainly a substitute for cash in circulation (M0), and will coexist with physical RMB”.9Working Group on E-CNY Research and Development of the People’s Bank of China, Progress of Research & Development of E-CNY in China, 3 (2021).

China’s CBDC is “at the most advanced stage” across all existing CBDC projects,10Auer, et al., BIS Working Papers No 880, 22 (2020). with pilots being conducted in 10 regions (e.g. Shenzhen) and the Beijing Winter Olympics use cases.11Mu, 13. 2021. It is estimated that “the total size of China’s digital currency could reach 1 trillion yuan (US$140 billion) over the coming years, equivalent to digitalising around one eighth of China’s cash”.12Karen Yeung, What Is China’s Sovereign Digital Currency?(2020), available at https://www.scmp.com/economy/china-economy/article/3083952/what-chinas-cryptocurrency-sovereign-digital-currency-and-why. International consumer brands, including McDonald’s, Starbucks, Subway, have also been involved in the e-CNY trial.13Frank Tang, China Includes McDonald’s, Starbucks, Subway on List of Foreign Firms to Test Digital Currency(2020), available at https://sg.news.yahoo.com/mcdonald-starbucks-subway-among-foreign-113523567.html. e-CNY has been used in various contexts, including paying travel subsidies to public servants.14Karen Yeung & Andrew Mullen, China Digital Currency: When Will the E-Yuan Be Launched, and What Will It Be Used For?(2021), available at https://www.scmp.com/economy/china-economy/article/3135886/china-digital-currency-when-will-e-yuan-be-launched-and-what.

Internationally, it has long been predicted that China “will be the first major country” to launch CBDC.15Bailey Reutzel & Pete Rizzo, Most Influential in Blockchain 2017 #6: Yao Qian(2017), available at https://www.coindesk.com/coindesk-most-influential-2017-6-yao-qian/. CNY currently accounts for approximately 4 per cent of global transactions,16Wilson Chow & Vicki Huff Eckert, China and the Race for the Future of Money(2021), available at https://www.pwc.com/gx/en/issues/reinventing-the-future/take-on-tomorrow/china-future-money.html. making China’s CBDC among “the potential major currency CBDC[s] with global implications”.17Dirk A. Zetzsche, et al., Sovereign Digital Currencies: The Future of Money and Payments?, University of Hong Kong Faculty of Law Research Paper No. 2020/053 1, 11 (2020). E-CNY is likely to be a game changer in international commerce,18Olsson, et al. 2021. and affect international transaction systems.19Briana Boland, China Bulletin: Local and Geopolitical Implications of the Digital Yuan, Dentons Flashpoint, 14 (2021). For CBDC, it is observed that “[w]hatever the Chinese do will affect other national economies”.20Vipin Bharathan, E-CNY Progress Report Reveals Telling Details About The Chinese Retail CBDC Project(2021), available at https://www.forbes.com/sites/vipinbharathan/2021/07/19/e-cny-progress-report-reveals-telling-details-about-the-chinese-retail-cbdc-project/?sh=1975aa6b6a59. China may selectively reshape international economic governance through CBDC practice and its participation in future international standard setting.21Heng Wang, Selective Reshaping: China’s Paradigm Shift in International Economic Governance, 23 Journal of International Economic Law 583, 593 (2020).

E-CNY is likely to evolve over time. For instance, e-CNY could deploy smart contracts, a concept explored in the e-CNY pilot.22Working Group on E-CNY Research and Development of the People’s Bank of China, 8, 14 (2021). Theoretically, smart contracts could interact with the programmed provision of subsidies or allowances to restrict the use of proceeds or create deadlines for such usage.23Olsson, et al. 2021.

This piece will first explore how to understand e-CNY and will provide a brief overview of its structure. The piece then discusses what e-CNY will mean for businesses.

Understanding E-CNY

It is not easy to fully understand e-CNY. For instance, e-CNY has been described as being “based on broad accounts, loosely coupled with bank accounts and has its system of value”.24Working Group on E-CNY Research and Development of the People’s Bank of China, 6 (2021). However, it is not immediately clear exactly what “loosely-coupled account linkage” means.25Bharathan. 2021. This piece will briefly discuss the management model and layered system of e-CNY, along with its digital wallet system and “managed anonymity”.

A “Centralized Management Model”

China’s CBDC features a “centralized management model” (PBOC issuing CBDC and being at the centre of the CBDC operational system).26Working Group on E-CNY Research and Development of the People’s Bank of China, 3 (2021). The PBOC manages the whole life cycle of CBDC27Id. at. and is responsible for cross-institutional connectivity,28Id. at, 8. meaning that all cross-institutional transactions need to go through the PBOC for the value transfer to occur.29Guohui Li & Meiruo Ma, Positive Progress Has Been Made in the E-CNY Research & Development Pilot: Central Bank Held a Media Briefing on the White Paper on Progress of Research & Development of E-CNY in China(2021), available at https://www.financialnews.com.cn/jg/dt/202107/t20210719_223623.html. For e-CNY wallets as discussed below, the PBOC is responsible for “wallet ecosystem management” and making e-CNY wallet rules.30Working Group on E-CNY Research and Development of the People’s Bank of China, 8, 9 (2021). E-CNY wallets are subject to both “centralized management” and “unified cognition”.31Id. at, 8-9.

CBDC operating agencies “submit transaction data to the central bank via asynchronous transmission on a timely basis”, enabling the central bank to “keep track of necessary data”.32Yifei Fan, Some Thoughts on CBDC Operations in China(2020), available at https://www.centralbanking.com/fintech/cbdc/7511376/some-thoughts-on-cbdc-operations-in-china. E-CNY would “revolutionise” the regulator’s capacity to “scrutinise the nation’s payment and financial system” with additional powers to track how money is used.33Yeung. 2020. E-CNY is to provide China visibility into the use of e-CNY and “allow China to use big data generated from” e-CNY transactions.34Olsson, et al. 2021. Essentially, the centralised system of E-CNY contrasts with private cryptocurrencies that are “designed to disperse power away from the government”.35Yeung. 2020.

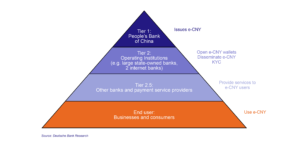

A Two-layer System

China’s CBDC features a two-layer, hybrid operational system that deals with issuance and circulation respectively.36Working Group on E-CNY Research and Development of the People’s Bank of China, 3 (2021). In the first layer, the PBOC issues e-CNY to second-tier institutions (e.g. currently six major state-owned banks, and two internet banks). In the second layer, second-tier institutions circulate the e-CNY to retail market actors including the public.37Mu, 13. 2021.

For this two-layer system, the PBOC issues CBDC to authorised operators (also termed as operating institutions, “Tier 2 institutions”, second-tier institutions),38Working Group on E-CNY Research and Development of the People’s Bank of China, 3 (2021);Deutsche Bank Research, Digital Yuan: What Is It and How Does It Work?(2021), available at https://www.db.com/news/detail/20210714-digital-yuan-what-is-it-and-how-does-it-work. which are commercial banks selected on various criteria (e.g. capital, technology).39Working Group on E-CNY Research and Development of the People’s Bank of China, 8 (2021). Authorised operators will lead the CBDC exchange services40Id. at. and circulation services.41Li & Ma. 2021. These authorised operators are e-CNY wallet distributors.42Ajay S. Mookerjee, What If Central Banks Issued Digital Currency?(2021), available at https://hbr.org/2021/10/what-if-central-banks-issued-digital-currency. A user needs to go to one of these authorised operators to open an e-CNY digital wallet.43Deutsche Bank Research. 2021. Subject to the PBOC’s “centralized management”, other commercial banks and institutions will also join to provide e-CNY circulation services.44Working Group on E-CNY Research and Development of the People’s Bank of China, 8 (2021). After the e-CNY wallet is opened, the user can access a variety of services provided by both the issuing bank (one of the Tier 2 institutions) as well as other banks and payment service providers. These other banks and providers are “Tier 2.5 institutions” (or related commercial institutions) that can supply payment and other services to e-CNY holders but cannot provide e-CNY exchange services.45Deutsche Bank Research. 2021. Authorised operators and “related commercial institutions jointly provide e-CNY circulation services and retail management, including innovation on payment product design, system development, scenario expansion, marketing, business processing as well as operation and maintenance”.46Working Group on E-CNY Research and Development of the People’s Bank of China, 8 (2021). A more detailed structure of e-CNY is illustrated in the Table 1 (below).

Table 1: The Structure of e-CNY

Adapted from Deutsche Bank Research, Digital Yuan: What Is It and How Does It Work?(2021), https://www.db.com/news/detail/20210714-digital-yuan-what-is-it-and-how-does-it-work (with slight adaptation of the original figure)

Adapted from Deutsche Bank Research, Digital Yuan: What Is It and How Does It Work?(2021), https://www.db.com/news/detail/20210714-digital-yuan-what-is-it-and-how-does-it-work (with slight adaptation of the original figure)

What is the relationship between the central bank and second-tier institutions? A commercial bank may be regarded as the “agent bank” of the central bank in this context. 47Steven L. Schwarcz, Regulating Digital Currencies: Towards an Analytical Framework, Duke Law School Public Law & Legal Theory Series No. 2021-09 1, 11 (2021). Former PBOC governor Zhou Xiaochuan referred to the view that commercial banks issuing CBDC are “like giving out envelopes; the banknotes in the envelope are the banknotes of the central bank, but commercial banks can have different envelop designs and anti-counterfeiting features”.48Zhou. 2020. However, he indicated that this metaphor is not accurate and clarified that “what’s inside the envelope can be the central bank currency, a central bank-issued reserve certificate or comfort letter, or even something designed by a commercial bank” and that “the first responsible entity is the second-tier institutions, not the central bank”.49Id. at. Second-tier institutions perform obligations like investing in equipment and technology and undertaking anti-money laundering controls (e.g. customer due diligence, reporting suspicious and large-value transactions, keeping customers’ identity data and transaction records).50Mu, 13. 2021;Working Group on E-CNY Research and Development of the People’s Bank of China, 10 (2021).

Digital Wallet

There is an e-CNY digital wallet ecosystem,51Working Group on E-CNY Research and Development of the People’s Bank of China, 6 (2021). which appears to consist of three layers: (i) the PBOC setting the rules; (ii) authorised operators, which include select banks, offering “basic functions”; and (iii) authorised operators working with “relevant market players to further develop various payment and financial products”.52Id. at, 9-10. Digital wallets differ from bank deposit accounts: “the balance in a bank deposit account represents a liability of the bank, whereas a DCEP in a digital wallet (both the digital RMB wallet and the sub-wallet) represents a direct liability of the PBOC, and the digital wallet offered by the bank is just an interface to allow users to access their DCEP”.53Olsson, et al. 2021.

Authorised operators “jointly develop and share apps on mobile devices” and “manage wallets, authenticate e-CNY, and develop wallet ecological platforms to enable operator-specific visual system[s] and special features as well as online and offline applications in all scenarios”.54Working Group on E-CNY Research and Development of the People’s Bank of China, 9 (2021). End users will download a PBOC-authorised digital wallet application which may be linked with a bank account.55Yeung & Mullen. 2021. The services provided by e-CNY wallets then enable end users to conduct electronic transactions and store their payment data.56Coco Feng, Fintech Giant Ant Group’s Mybank Joins China’s Digital Yuan Platform(2021), available at https://www.scmp.com/tech/big-tech/article/3133227/fintech-giant-ant-groups-mybank-joins-chinas-digital-yuan-platform?module=perpetual_scroll&pgtype=article&campaign=3133227.

Managed Anonymity

Managed anonymity is a major feature of e-CNY.57Working Group on E-CNY Research and Development of the People’s Bank of China, 13 (2021). When using an e-CNY wallet app where the user’s identity has been verified, the PBOC is to know the user’s identity.58Olsson, et al. 2021. However, transactions conducted through the e-CNY wallet app will only transmit the wallet ID, with neither the other transaction parties nor the sub-wallet account bank knowing the user’s identity.59Id. at. This means that users could “hide their identity from counterparties”, making it “more difficult for online platforms to collect user information”.60Deutsche Bank Research. 2021. The regulation of e-CNY in this regard is yet to be seen. For instance, it is not clear whether and how existing rules on the sharing of government information among government agencies (e.g. the Notice of the State Council on Issuing the Interim Measures for the Administration of Sharing of Government Information Resources, and Guidelines for the Preparation of Catalogues of Government Information Resources) will apply to e-CNY. 61Jiang & Lucero, 18 (2021).

What Does E-CNY Mean?

To understand what e-CNY means for domestic and international business, business leaders first need to understand China’s unique approach to CBDC.

China’s Unique CBDC Approach

On one hand, China’s CBDC shares similarities with other CBDCs. For example, CBDCs generally may create “new monetary policy levers” and “currency with time limits or other spending conditions (e.g. required spending on durable goods)” that can “create highly targeted monetary interventions in a national economy”.62Sarah Allen, et al., Design Choices for Central Bank Digital Currency(2020), available at https://www.brookings.edu/blog/up-front/2020/07/23/design-choices-for-central-bank-digital-currency/.

On the other hand, China’s CBDC pathway is likely to differ from other states in terms of its regulations (e.g. privacy, the attitude towards private cryptocurrencies) and technical design. A state’s approach to CBDC reflects their “political-economic priorities and features”.63Ashton de Silva, et al., Central Bank Digital Currencies (CBDCs): A Comparative Review, A Report Prepared for CPA Australia by RMIT University, 5 (2021). China’s CBDC echoes China’s state-led economy through, inter alia, “centralis[ing] control of the underlying monetary instrument across all payment systems” and “controlling currency inflows and outflows into the RMB area”.64Zetzsche, et al., University of Hong Kong Faculty of Law Research Paper No. 2020/053, 6 (2020).

The crackdown on private cryptocurrencies is a unique aspect of China’s CBDC approach. China’s CBDC approach should be viewed with a functional lens, including the attitude towards private cryptocurrencies that are regarded as the opposite of CBDC.65James Kynge & Sun Yu, Virtual Control: The Agenda behind China’s New Digital Currency(2021), available at https://www.ft.com/content/7511809e-827e-4526-81ad-ae83f405f623. It seems that e-CNY is partially driven by the response to Diem, the global stablecoin, and capital flight.66Karen Yeung, China Not Among Major Central Banks in Talks on Global Digital Currency Principles, South China Morning Post(2020), available at https://www.scmp.com/economy/china-economy/article/3104905/china-not-among-major-central-banks-talks-global-digital?utm_medium=email&utm_source=mailchimp&utm_campaign=enlz-scmp_china&utm_content=20201009&tpcc=enlz-scmp_china&MCUID=b2992489b1&MCCampaignID=c2e928c32f&MCAccountID=3775521f5f542047246d9c827&tc=5. China’s crackdown on private cryptocurrencies is reflected in the Law of the People’s Bank of China (Amendment Draft for Consultation)(Draft) which proposes to forbid substitute currencies in digital and physical forms (including RMB-pegged digital tokens).67People’s Bank of China, Law of the People’s Bank of China (Amendment Draft for Consultation) Article 22 (2020). It is observed that the PBOC “would frown upon any stablecoins pegged to the renminbi”.68Eswar S. Prasad, The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance 254 (Belknap Press. 2021).

Meanwhile, it proposes to extend the forms of RMB to a digital one and legalise China’s CBDC.69People’s Bank of China, Explanation for the Law of the People’s Bank of China (Amendment Draft for Consultation)(2020), available at http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4115077/index.html;People’s Bank of China, Law of the People’s Bank of China (Amendment Draft for Consultation) Article 19. 2020. More recently, China has prohibited all activities concerning private virtual currencies through a notice issued by ten agencies including the Supreme People’s Court.70Eleanor Olcott & Eva Szalay, China Expands Crackdown by Declaring All Crypto Activities ‘Illegal’(2021), available at https://www.ft.com/content/31f7edf7-8e05-46e1-8b13-061532f8db5f. This would affect not only administrative decisions but also court judgments. This prohibition on cryptocurrencies differs from many other economies where CBDC and private digital currencies could co-exist.

Other differences in China’s CBDC approach include the role of second-tier institutions and e-CNY’s nature mainly as a retail CBDC. According to Zhou Xiaochuan, former Governor of the PBOC, one of major differences between China and the G7 in terms of CBDC is that second-tier institutions are expected to play a greater role and take more responsibilities and that DC/EP pays more attention to improving the domestic retail payment system.71Weimiao Cheng, What Is the Difference Between China’s DC/Ep and g7 Central Bank Digital Currency? Zhou Xiaochuan Said This(2020), available at http://www.bjnews.com.cn/finance/2020/10/28/782205.html. Research on CBDC by many advanced economies has focused on wholesale CBDC, whereas China is leading the development of retail CBDCs.72Ping Xie, Ping Xie: After CBDC Infrastructure Is Developed, It Could Break Third-Party Payment Monopoly(2020), available at https://mp.weixin.qq.com/s/uHQs0mIPEZQIe8R5xz6vfA. As a complement to or substitute for cash, retail CBDCs represent “a more revolutionary change” than wholesale CBDCs.73Prasad, 12. 2021. Wholesale CBDCs are often “restricted-access digital token[s] for wholesale settlements like interbank payments”.74Yang Ji & Yan Shen, Introduction to the Special Issue on Digital Currency, China Economic Journal 1, 1-2 (2021). Retail CBDCs are digital fiat monies that are widely accessible and available to the public, and “would be a central bank liability and form part of the base money supply”.75Kiff, et al., IMF Working Paper No. 20/104, 7 (2020). That said, China appears to “explor[e] both wholesale and retail CBDC”.76Silva, et al., A Report Prepared for CPA Australia by RMIT University, 5 (2021). Other differences, including data regulation and how e-CNY will be driven by the promotion of RMB internationalisation,77Yeung, China Not Among Major Central Banks in Talks on Global Digital Currency Principles. 2020. remain to be seen.

The Implications for Businesses

E-CNY may profoundly affect business, product offerings and business practices in commerce related to China. If China’s CBDC practice and standards affect international practice (such as through standard making), they may affect other businesses in the long run. In the short term, CBDC is likely to affect wide-ranging international businesses, particularly those with a presence in China or those who commonly transact with Chinese actors. The legal tender status of e-CNY means that the acceptance of e-CNY is eventually to be mandatory in China.78Olsson, et al. 2021. If everything goes smoothly, e-CNY will likely be “the cash of the future” in China.79Mookerjee. 2021. E-CNY’s standing as a legal tender will impact financial and technology sectors (e.g. telecommunication companies and commercial banks that design related products and services), ordinary businesses in other sectors, and the public that use fiat currency. The visibility on the use of money will be a new scenario faced by businesses and other stakeholders.

Businesses such as banks could face various issues including:

- the interaction between e-CNY and bank accounts and mobile payment services;

- possible cross-border payment by individuals and firms using e-CNY;

- compliance issues (e.g. anti-money laundering and counter-terrorism financing controls, consumer protection and disclosure, data privacy, licensing and prudential conduct, interoperability with other currencies and systems), and relatedly the division of tasks between onshore and offshore entities; and

- cash management and foreign exchange strategies.80Olsson, et al. 2021.

Businesses may also face other CBDC-related issues, including financial inclusion.81Xie. 2020.

Businesses that may engage with e-CNY (e.g. receiving payment in e-CNY) are advised to understand the implications of CBDC and take measures to manage its implementation. Involving many of their teams (e.g. management and digital asset teams), businesses need to explore CBDC’s possible impact on their businesses and plan a strategy to build the capacity to perform business operations in the new landscape and manage risks (e.g. friction in CBDC transactions).82PWC, The Rise of Central Bank Digital Currencies (CBDCs): What You Need to Know(2019), available at https://www.pwc.com/gx/en/financial-services/pdf/the-rise-of-central-bank-digital-currencies.pdf;Chow & Eckert. 2021.

First, it is crucial to assess possible regulatory changes ranging from transaction data to the possible monetary, tax and other regulatory measures of e-CNY (such as those on the use of e-CNY). Businesses operating in China would need to “monitor any arising risks”, understand how financial products “fit within the new DCEP ecosystem”, adapt their China-related operations to support DCEP, and “adjust reporting requirements and financial reserves required due to DCEP use”.83Betty Louie & Martha Wang, China’s Digital Currency and What This Could Mean For Foreign Companies and Financial Institutions in China(2021), available at https://www.jdsupra.com/legalnews/china-s-digital-currency-and-what-this-7987963/. Administrative rules on e-CNY, along with “the rulebook and technical codes”, will be introduced or developed.84Working Group on E-CNY Research and Development of the People’s Bank of China, 14 (2021). A new regulatory framework may emerge to addresses various aspects of e-CNY, including its circulation and use. Separate regulatory measures and rules for e-CNY are likely to be adopted.85Sina.com.cn, Mu Changchun: Three Major Challenges Facing the Official Launch of the Digital RMB(2021), available at https://finance.sina.com.cn/blockchain/roll/2021-11-04/doc-iktzqtyu5313884.shtml.

Second, it is important to understand any CBDC-related changes in business practice. E-CNY may lead to a new economic ecosystem (e.g. financial instruments denominated in e-CNY) that goes beyond a new “currency infrastructure”.86Olsson, et al. 2021. For instance, there would likely be competition for distributing electronic wallets featuring user-friendly and innovative solutions.87Mookerjee. 2021. E-CNY’s introduction means that financial and non-financial businesses will face pressures to provide more digital payment choices and enhanced customer experiences.88Chow & Eckert. 2021. As banks are not permitted to charge users for settling e-CNY transactions, this could “pressure third-party platforms to provide more favourable terms for users”.89Boland, Dentons Flashpoint, 17 (2021). The list is only likely to grow. Through new technologies and applications, e-CNY may be connected with artificial intelligence, big data, cloud computing, and the internet of things.90Olsson, et al. 2021.

Third, the regulatory and business changes surrounding CBDC could further lead to changes in both “hardware” and “software”. For an example of “hardware”, businesses like retail banks, merchants, and payment service providers, may need to assess the level of needed infrastructure investment to work with CBDC.91Ian De Bode & Matt HigginsonMarc Niederkorn, CBDC and Stablecoins: Early Coexistence on an Uncertain Road, (2021). For the use of e-CNY, the acceptance systems of the merchants need to be transformed and upgraded.92Sina.com.cn. 2021. CBDC could “render much of the physical infrastructure of banking redundant” with the move towards increased digitalisation of the ecosystem.93Mookerjee. 2021. As an example of “software”, it is argued that contracts with third-party financial custodians may be considered by businesses to accommodate e-CNY (e.g. digital wallets).94Jemma Xu & Dan Prud’homme, China’s Digital Currency Revolution and Implications for International Business Strategy, 2 (2020).

Finally, CBDC will bring both opportunities and risks. CBDC may bring opportunities, depending on the situation of specific businesses. As an example, banks may leverage e-CNY digital wallets to “cross-sell other high-margin services”.95Sundeep Gantori, et al., Information Technology: Understanding China’s Digital Currency and Blockchain Initiatives, 10 (2020). As a digital currency carrying transaction information, CBDC could bring opportunities for innovative financial offerings and, relatedly, increasing investor demand for these innovative products.96Chow & Eckert. 2021. Substantially changing China’s digital payment market, e-CNY “offers an entry point for China’s big banks to break into a business segment that is currently dominated by big tech firms”.97Deutsche Bank Research. 2021.

CBDC-related risks, including operational and financial risks,98Xie. 2020. may arise from the systems that CBDC involves, ranging from payment to e-commerce. For instance, risks may arise from financing, currency and payment operations99Chow & Eckert. 2021. that connect to “existing and newly developing payment systems and currencies”.100Bharathan. 2021. E-CNY’s simulation of ordinary banking activities, ranging from payments and deposits to withdrawals from a digital wallet,101Yeung & Mullen. 2021. may require businesses to consider internal controls for data protection and cybersecurity.102Louie & Wang. 2021.

The Implications for International Business

At the very least, China’s CBDC may be used internationally in broad contexts like trade. E-CNY’s possible use for cross-border payments may “support China’s efforts to have the RMB used more widely for pricing and settlement of trade transactions, the financing of projects around the region” and become an international reserve currency.103Olsson, et al. 2021. Meanwhile, the time and expenses involved in international settlement seem to be “more due to the gatekeeping capacities of banks and regulatory requirements of different countries, rather than specific technological issues”.104Jiang & Lucero, 17 (2021). Therefore, the operation and effects of the possible international use of e-CNY are yet to be seen.

Various issues deserve the attention of international businesses that may be affected by the introduction of CBDC. First, businesses are likely to “explore interoperability options when conducting cross-border trade” if e-CNY “leads to an alternative international payments system vis-à-vis the current US-led system”.105Xu & Prud’homme, 3 (2020). Second, multinational enterprises may face different regulatory requirements across jurisdictions in cross-border transactions. There is likely to be differences regarding the treatment of privacy (e.g. central banks’ access to “granular transaction data on individuals”) among China and other economies like the US.106Martin Chorzempa, China, the United States, and Central Bank Digital Currencies: How Important Is It to Be First?, China Economic Journal 1, 5 (2021). Third, e-CNY direct payments between parties from different states could reduce the demand for correspondent banking services and SWIFT financial messaging and payment systems.107Tao Zhang, New Forms of Digital Money: Implications for Monetary and Financial Stability(2021), available at https://www.imf.org/en/News/Articles/2020/10/30/sp103020-new-forms-of-digital-money. That said, a joint venture between SWIFT, the global financial messaging system, and China’s department responsible for e-CNY is exploring the international use of e-CNY.108Karen Yeung, China’s SWIFT Joint Venture Shows Beijing Eyeing Global Digital Currency Use, to Internationalise Yuan(2021), available at https://sg.news.yahoo.com/china-swift-joint-venture-shows-123046035.html. Last and more broadly, businesses need to consider questions like the implications for supply chains if more transactions are denominated in digital currencies.109Chow & Eckert. 2021. Observers also indicate that “the web of individual transactions via DCEP could evolve greater B2B usage with broader operating implications”.110Id. at. However, these issues are not exhaustive, and challenges for businesses will continue to evolve.

Conclusion

With the increased digitisation of transactions, businesses and other stakeholders need to explore regulatory (including those concerning privacy), data, security and other implications arising from CBDC.111Olsson, et al. 2021. The confidence of users in CBDC and its regulation will be crucial. Many questions deserve further attention. For instance, are there first-mover advantages or last-mover advantages for businesses?

E-CNY is both a moving and unique target, affecting “hardware” and “software”. By considering the some of the implications of e-CNY explored in this article, businesses can begin to adequately prepare for a landscape changed by e-CNY and emerging CBDCs.

The author is grateful to Layton Hubble for the excellent assistance and comments.

Endnotes

| ↑1 | John Kiff, et al., A Survey of Research on Retail Central Bank Digital Currency, IMF Working Paper No. 20/104, 5 (2020). |

|---|---|

| ↑2 | Yves Mersch, Yves Mersch: An ECB Digital Currency – a Flight of Fancy?(2020), available at https://www.bis.org/review/r200511a.pdf. |

| ↑3 | Changchun Mu, Digital Currency Institute of the People’s Bank of China, in Inthanon-LionRock to mBridge: Building a Multi CBDC Platform for International Payments 13, (BIS Innovation Hub Hong Kong Centre, et al. eds., 2021). |

| ↑4 | Raphael Auer, et al., Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies, BIS Working Papers No 880, 6 (2020). |

| ↑5 | Yanting Wu, Why Does the Digital RMB Accelerate?, Outlook Weekly (2021). |

| ↑6 | Xiaochuan Zhou, Understanding China’s Central Bank Digital Currency(2020), available at http://www.cf40.com/en/news_detail/11481.html. |

| ↑7 | David Olsson, et al., China’s Digital RMB – Is Your Business Ready?(2021), available at https://www.kwm.com/en/au/knowledge/insights/chinas-digital-rmb-is-your-business-ready-20210427. |

| ↑8 | Jiaying Jiang & Karman Lucero, Background and Implications of China’s E-CNY, 2 (2021). |

| ↑9 | Working Group on E-CNY Research and Development of the People’s Bank of China, Progress of Research & Development of E-CNY in China, 3 (2021). |

| ↑10 | Auer, et al., BIS Working Papers No 880, 22 (2020). |

| ↑11 | Mu, 13. 2021. |

| ↑12 | Karen Yeung, What Is China’s Sovereign Digital Currency?(2020), available at https://www.scmp.com/economy/china-economy/article/3083952/what-chinas-cryptocurrency-sovereign-digital-currency-and-why. |

| ↑13 | Frank Tang, China Includes McDonald’s, Starbucks, Subway on List of Foreign Firms to Test Digital Currency(2020), available at https://sg.news.yahoo.com/mcdonald-starbucks-subway-among-foreign-113523567.html. |

| ↑14 | Karen Yeung & Andrew Mullen, China Digital Currency: When Will the E-Yuan Be Launched, and What Will It Be Used For?(2021), available at https://www.scmp.com/economy/china-economy/article/3135886/china-digital-currency-when-will-e-yuan-be-launched-and-what. |

| ↑15 | Bailey Reutzel & Pete Rizzo, Most Influential in Blockchain 2017 #6: Yao Qian(2017), available at https://www.coindesk.com/coindesk-most-influential-2017-6-yao-qian/. |

| ↑16 | Wilson Chow & Vicki Huff Eckert, China and the Race for the Future of Money(2021), available at https://www.pwc.com/gx/en/issues/reinventing-the-future/take-on-tomorrow/china-future-money.html. |

| ↑17 | Dirk A. Zetzsche, et al., Sovereign Digital Currencies: The Future of Money and Payments?, University of Hong Kong Faculty of Law Research Paper No. 2020/053 1, 11 (2020). |

| ↑18 | Olsson, et al. 2021. |

| ↑19 | Briana Boland, China Bulletin: Local and Geopolitical Implications of the Digital Yuan, Dentons Flashpoint, 14 (2021). |

| ↑20 | Vipin Bharathan, E-CNY Progress Report Reveals Telling Details About The Chinese Retail CBDC Project(2021), available at https://www.forbes.com/sites/vipinbharathan/2021/07/19/e-cny-progress-report-reveals-telling-details-about-the-chinese-retail-cbdc-project/?sh=1975aa6b6a59. |

| ↑21 | Heng Wang, Selective Reshaping: China’s Paradigm Shift in International Economic Governance, 23 Journal of International Economic Law 583, 593 (2020). |

| ↑22 | Working Group on E-CNY Research and Development of the People’s Bank of China, 8, 14 (2021). |

| ↑23 | Olsson, et al. 2021. |

| ↑24 | Working Group on E-CNY Research and Development of the People’s Bank of China, 6 (2021). |

| ↑25 | Bharathan. 2021. |

| ↑26 | Working Group on E-CNY Research and Development of the People’s Bank of China, 3 (2021). |

| ↑27 | Id. at. |

| ↑28 | Id. at, 8. |

| ↑29 | Guohui Li & Meiruo Ma, Positive Progress Has Been Made in the E-CNY Research & Development Pilot: Central Bank Held a Media Briefing on the White Paper on Progress of Research & Development of E-CNY in China(2021), available at https://www.financialnews.com.cn/jg/dt/202107/t20210719_223623.html. |

| ↑30 | Working Group on E-CNY Research and Development of the People’s Bank of China, 8, 9 (2021). |

| ↑31 | Id. at, 8-9. |

| ↑32 | Yifei Fan, Some Thoughts on CBDC Operations in China(2020), available at https://www.centralbanking.com/fintech/cbdc/7511376/some-thoughts-on-cbdc-operations-in-china. |

| ↑33 | Yeung. 2020. |

| ↑34 | Olsson, et al. 2021. |

| ↑35 | Yeung. 2020. |

| ↑36 | Working Group on E-CNY Research and Development of the People’s Bank of China, 3 (2021). |

| ↑37 | Mu, 13. 2021. |

| ↑38 | Working Group on E-CNY Research and Development of the People’s Bank of China, 3 (2021);Deutsche Bank Research, Digital Yuan: What Is It and How Does It Work?(2021), available at https://www.db.com/news/detail/20210714-digital-yuan-what-is-it-and-how-does-it-work. |

| ↑39 | Working Group on E-CNY Research and Development of the People’s Bank of China, 8 (2021). |

| ↑40 | Id. at. |

| ↑41 | Li & Ma. 2021. |

| ↑42 | Ajay S. Mookerjee, What If Central Banks Issued Digital Currency?(2021), available at https://hbr.org/2021/10/what-if-central-banks-issued-digital-currency. |

| ↑43 | Deutsche Bank Research. 2021. |

| ↑44 | Working Group on E-CNY Research and Development of the People’s Bank of China, 8 (2021). |

| ↑45 | Deutsche Bank Research. 2021. |

| ↑46 | Working Group on E-CNY Research and Development of the People’s Bank of China, 8 (2021). |

| ↑47 | Steven L. Schwarcz, Regulating Digital Currencies: Towards an Analytical Framework, Duke Law School Public Law & Legal Theory Series No. 2021-09 1, 11 (2021). |

| ↑48 | Zhou. 2020. |

| ↑49 | Id. at. |

| ↑50 | Mu, 13. 2021;Working Group on E-CNY Research and Development of the People’s Bank of China, 10 (2021). |

| ↑51 | Working Group on E-CNY Research and Development of the People’s Bank of China, 6 (2021). |

| ↑52 | Id. at, 9-10. |

| ↑53 | Olsson, et al. 2021. |

| ↑54 | Working Group on E-CNY Research and Development of the People’s Bank of China, 9 (2021). |

| ↑55 | Yeung & Mullen. 2021. |

| ↑56 | Coco Feng, Fintech Giant Ant Group’s Mybank Joins China’s Digital Yuan Platform(2021), available at https://www.scmp.com/tech/big-tech/article/3133227/fintech-giant-ant-groups-mybank-joins-chinas-digital-yuan-platform?module=perpetual_scroll&pgtype=article&campaign=3133227. |

| ↑57 | Working Group on E-CNY Research and Development of the People’s Bank of China, 13 (2021). |

| ↑58 | Olsson, et al. 2021. |

| ↑59 | Id. at. |

| ↑60 | Deutsche Bank Research. 2021. |

| ↑61 | Jiang & Lucero, 18 (2021). |

| ↑62 | Sarah Allen, et al., Design Choices for Central Bank Digital Currency(2020), available at https://www.brookings.edu/blog/up-front/2020/07/23/design-choices-for-central-bank-digital-currency/. |

| ↑63 | Ashton de Silva, et al., Central Bank Digital Currencies (CBDCs): A Comparative Review, A Report Prepared for CPA Australia by RMIT University, 5 (2021). |

| ↑64 | Zetzsche, et al., University of Hong Kong Faculty of Law Research Paper No. 2020/053, 6 (2020). |

| ↑65 | James Kynge & Sun Yu, Virtual Control: The Agenda behind China’s New Digital Currency(2021), available at https://www.ft.com/content/7511809e-827e-4526-81ad-ae83f405f623. |

| ↑66 | Karen Yeung, China Not Among Major Central Banks in Talks on Global Digital Currency Principles, South China Morning Post(2020), available at https://www.scmp.com/economy/china-economy/article/3104905/china-not-among-major-central-banks-talks-global-digital?utm_medium=email&utm_source=mailchimp&utm_campaign=enlz-scmp_china&utm_content=20201009&tpcc=enlz-scmp_china&MCUID=b2992489b1&MCCampaignID=c2e928c32f&MCAccountID=3775521f5f542047246d9c827&tc=5. |

| ↑67 | People’s Bank of China, Law of the People’s Bank of China (Amendment Draft for Consultation) Article 22 (2020). |

| ↑68 | Eswar S. Prasad, The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance 254 (Belknap Press. 2021). |

| ↑69 | People’s Bank of China, Explanation for the Law of the People’s Bank of China (Amendment Draft for Consultation)(2020), available at http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4115077/index.html;People’s Bank of China, Law of the People’s Bank of China (Amendment Draft for Consultation) Article 19. 2020. |

| ↑70 | Eleanor Olcott & Eva Szalay, China Expands Crackdown by Declaring All Crypto Activities ‘Illegal’(2021), available at https://www.ft.com/content/31f7edf7-8e05-46e1-8b13-061532f8db5f. |

| ↑71 | Weimiao Cheng, What Is the Difference Between China’s DC/Ep and g7 Central Bank Digital Currency? Zhou Xiaochuan Said This(2020), available at http://www.bjnews.com.cn/finance/2020/10/28/782205.html. |

| ↑72 | Ping Xie, Ping Xie: After CBDC Infrastructure Is Developed, It Could Break Third-Party Payment Monopoly(2020), available at https://mp.weixin.qq.com/s/uHQs0mIPEZQIe8R5xz6vfA. |

| ↑73 | Prasad, 12. 2021. |

| ↑74 | Yang Ji & Yan Shen, Introduction to the Special Issue on Digital Currency, China Economic Journal 1, 1-2 (2021). |

| ↑75 | Kiff, et al., IMF Working Paper No. 20/104, 7 (2020). |

| ↑76 | Silva, et al., A Report Prepared for CPA Australia by RMIT University, 5 (2021). |

| ↑77 | Yeung, China Not Among Major Central Banks in Talks on Global Digital Currency Principles. 2020. |

| ↑78 | Olsson, et al. 2021. |

| ↑79 | Mookerjee. 2021. |

| ↑80 | Olsson, et al. 2021. |

| ↑81 | Xie. 2020. |

| ↑82 | PWC, The Rise of Central Bank Digital Currencies (CBDCs): What You Need to Know(2019), available at https://www.pwc.com/gx/en/financial-services/pdf/the-rise-of-central-bank-digital-currencies.pdf;Chow & Eckert. 2021. |

| ↑83 | Betty Louie & Martha Wang, China’s Digital Currency and What This Could Mean For Foreign Companies and Financial Institutions in China(2021), available at https://www.jdsupra.com/legalnews/china-s-digital-currency-and-what-this-7987963/. |

| ↑84 | Working Group on E-CNY Research and Development of the People’s Bank of China, 14 (2021). |

| ↑85 | Sina.com.cn, Mu Changchun: Three Major Challenges Facing the Official Launch of the Digital RMB(2021), available at https://finance.sina.com.cn/blockchain/roll/2021-11-04/doc-iktzqtyu5313884.shtml. |

| ↑86 | Olsson, et al. 2021. |

| ↑87 | Mookerjee. 2021. |

| ↑88 | Chow & Eckert. 2021. |

| ↑89 | Boland, Dentons Flashpoint, 17 (2021). |

| ↑90 | Olsson, et al. 2021. |

| ↑91 | Ian De Bode & Matt HigginsonMarc Niederkorn, CBDC and Stablecoins: Early Coexistence on an Uncertain Road, (2021). |

| ↑92 | Sina.com.cn. 2021. |

| ↑93 | Mookerjee. 2021. |

| ↑94 | Jemma Xu & Dan Prud’homme, China’s Digital Currency Revolution and Implications for International Business Strategy, 2 (2020). |

| ↑95 | Sundeep Gantori, et al., Information Technology: Understanding China’s Digital Currency and Blockchain Initiatives, 10 (2020). |

| ↑96 | Chow & Eckert. 2021. |

| ↑97 | Deutsche Bank Research. 2021. |

| ↑98 | Xie. 2020. |

| ↑99 | Chow & Eckert. 2021. |

| ↑100 | Bharathan. 2021. |

| ↑101 | Yeung & Mullen. 2021. |

| ↑102 | Louie & Wang. 2021. |

| ↑103 | Olsson, et al. 2021. |

| ↑104 | Jiang & Lucero, 17 (2021). |

| ↑105 | Xu & Prud’homme, 3 (2020). |

| ↑106 | Martin Chorzempa, China, the United States, and Central Bank Digital Currencies: How Important Is It to Be First?, China Economic Journal 1, 5 (2021). |

| ↑107 | Tao Zhang, New Forms of Digital Money: Implications for Monetary and Financial Stability(2021), available at https://www.imf.org/en/News/Articles/2020/10/30/sp103020-new-forms-of-digital-money. |

| ↑108 | Karen Yeung, China’s SWIFT Joint Venture Shows Beijing Eyeing Global Digital Currency Use, to Internationalise Yuan(2021), available at https://sg.news.yahoo.com/china-swift-joint-venture-shows-123046035.html. |

| ↑109 | Chow & Eckert. 2021. |

| ↑110 | Id. at. |

| ↑111 | Olsson, et al. 2021. |