Make Transparency Clear

How to Fight Bribery and Corruption in Your Law Firm

This article discusses some of the key measures for law firms to combat bribery and corruption, including a written anti-bribery and corruption policy and internal controls.

Introduction

The risks of bribery and corruption are a perennial threat to the legal profession. A 2010 survey conducted by the International Bar Association (IBA)1 International Bar Association, Organisation for Economic Co-operation and Development and United Nations Office on Drugs and Crime, “Risks and threats of corruption and the legal profession: Survey 2010” <https://www.anticorruptionstrategy.org/AC_strategy_legal_profession_report.aspx> (accessed 4 September 2018) (“IBA Corruption Risks Survey”) at p 6. found that:

- More than a fifth of the 642 legal practitioners polled2 From 95 jurisdictions. See IBA Corruption Risks Survey at p 8. had or might have been approached to act as an agent or middleman in a transaction that could reasonably be suspected to involve international corruption.3 IBA Corruption Risks Survey at p 6.

- Nearly a third of respondents said a legal professional they knew had been involved in international corruption offences.4 IBA Corruption Risks Survey at p 6.

- Nearly 30 per cent of respondents agreed they had lost business to corrupt law firms or individuals who had engaged in international bribery and corruption.5 IBA Corruption Risks Survey at p 6.

In Singapore, during the past 3 years (2015-2017), private sector cases formed the majority (85%-92%) of all the cases registered for investigation by the Corrupt Practices Investigation Bureau (CPIB), although the number has remained low.6 CPIB Research Room, “Corruption in Singapore Remains Low” <https://www.cpib.gov.sg/research-room/corruption-situation-singapore> (accessed 25 October 2018).

In 2017, the CPIB published a guide in 2017 entitled “PACT: A Practical Anti-Corruption Guide for Businesses in Singapore” (PACT) to help local business owners prevent corruption in their companies.7 Corrupt Practices Investigation Bureau, “PACT: A practical anti-corruption guide for businesses in Singapore” (2017) <https://www.cpib.gov.sg/sites/cpibv2/files/publication-documents/PACT%20A%20Practical%20Anti-Corruption%20Guide%20For%20Businesses%20in%20Singapore%20%282018%29.pdf> (accessed 16 October 2018). While PACT is not specifically addressed to the legal profession, law practices can use it as a starting point to develop or refine their anti-bribery and corruption program.

Drawing from PACT and other sources, this article examines some of the key measures for law firms to combat bribery and corruption, including a written anti-bribery and corruption policy and internal controls.

The PACT Framework

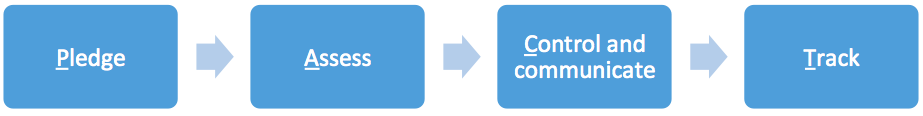

PACT provides a four-step framework to help local companies fight corruption:

1. Pledge

Fundamental to any anti-bribery and corruption program is the “tone from the top”.8 PACT at p 13. The law firm’s leadership should emphasise in its policy the severe consequences of corruption.9 Amy Bell, Anti-Bribery Toolkit (Law Society Publishing, 2012) (“Anti-Bribery Toolkit”) at p 35. PACT notes that “[c]orruption undermines healthy competition, raises the cost of business operations, destroys corporate integrity and poses reputational risks for private businesses”.10 PACT at p 4.

In its Practice Note on the Bribery Act 2010 (UK Anti-Bribery Practice Note), the Law Society of England and Wales also emphasised the need for commitment by the law firm’s leadership.11 Law Society of England and Wales, “Practice Note: Bribery Act 2010” <https://www.lawsociety.org.uk/support-services/advice/practice-notes/bribery-act-2010/> (accessed 3 September 2018). Unless the senior management visibly supports the law firm’s policy, employees are unlikely to comply with it.12 UK Anti-Bribery Practice Note at para 3.1. It is therefore important for senior management to pledge and commit to a zero-tolerance approach towards corruption.13 PACT at p 13.

PACT recommends that companies implement a formally documented anti-corruption policy as well as create a company code of conduct to set out “a uniform standard of conduct and ethics in all areas of business activities where corrupt practices are likely to occur”.14 PACT at pp 12-3. A sample policy and code is provided in Appendices B and C of PACT respectively.15 PACT at pp 41-2.

2. Assess

Risk Identification

Before drafting your law firm’s policy, you should first identify common and specific areas of corruption risks. Common areas of corruption risks include gifts and entertainment as well as conflict of interest.16 PACT at pp 16-7.

Specific areas of corruption risks depend on various factors such as “industry, company size and business operations”.17 PACT at p 18. PACT suggests practical ways to identify your company’s specific corruption risks, such as holding consultations with employees whose roles are more vulnerable to corruption, “network[ing] with business partners to share best practices and knowledge”, and “hir[ing] external practical consultants”.18 PACT at p 18.

In this section, we look at two types of common corruption risks: (a) gifts and entertainment; and (b) charitable donations.

(a) Gifts and entertainment

Giving gifts and providing hospitality and entertainment are often used to build relationships and goodwill in business.19 PACT at p 16; UK Anti-Bribery Practice Note at para 3.5. However, it may be a corrupt practice if gifts are made with “the deliberate intention of gaining or trying to gain an unfair business advantage”.20 PACT at p 16.

Giving gifts

While some companies may decide to ban giving or receiving gifts, this is not strictly necessary.21 PACT at p 16. If your company permits giving and receiving gifts, PACT recommends establishing “clear and transparent boundaries” on when such giving or receiving is appropriate.22 PACT at p 16. Similarly, the UK Anti-Bribery Practice Note recommends specifying a financial limit for gifts,23 UK Anti-Bribery Practice Note at para 3.5. which should also account for “the cumulative impact of several small gifts”.24 UK Anti-Bribery Practice Note at para 3.5. You could also consider a declaration form or gift log for gifts given and received.25 PACT, Appendix D at p 43; UK Anti-Bribery Practice Note at para 3.5.

Receiving gifts

Under Singapore’s Prevention of Corruption Act (“PCA”), 26 Cap 241, 1993 Rev Ed. someone who corruptly receives gifts and entertainment is also liable for corruption, regardless of whether the person fulfilled or had the power to fulfil the giver’s request.27 PACT at p 16; see also PCA at s 9(1). Employees responsible for procurement, sales or marketing may face an increased risk of becoming involved in corrupt practices.28 PACT at p 16. Hence, your law firm’s policy should also establish guidelines on when employees may receive gifts.

If your law firm refers work to other professionals, you should be aware that they may offer your firm gifts or hospitality.29 UK Anti-Bribery Practice Note at para 3.5. Your law firm should consider how to handle such offers, including what approval levels and threshold limits would be appropriate.30 UK Anti-Bribery Practice Note at para 3.5.

(b) Charitable donations

Your law firm may wish to donate to charities that may or may not be your law firm’s clients. Requests for charitable donations should be carefully assessed as they could conceal a request for a bribe.31 Transparency International UK, “How to Bribe: A Typology of Bribe-Paying and How to Stop It” (January 2014) <http://www.transparency.org.uk/publications/how-to-bribe-a-typology-of-bribe-paying-and-how-to-stop-it/#.W7GiymgzaUk> (accessed 1 October 2018) at p 16. Hence, if your law firm makes charitable donations, you should ensure that the charity is a legitimate charity.32 UK Anti-Bribery Practice Note at para 3.7.

You could consider using the following checks in your law firm’s policy on charitable donations.

- Is the charity registered?33 Tim Prior, Lexcel Risk Management Toolkit (Law Society Publishing, 3rd Ed, 2017) (“Lexcel Toolkit”) at p 80; UK Anti-Bribery Practice Note at 3.7.

- Can the firm donate directly to the charity and not to an individual purportedly linked to it?34 Lexcel Toolkit at p 80; UK Bribery Practice Note at para 3.7.

- Does the charity have any connection to a client or to an organisation that may influence the firm’s business?35 Lexcel Toolkit at p 80; UK Bribery Practice Note at para 3.7.

If the charity is connected to an organisation that may influence your business, your policy could provide, for example, that the firm will wait until a deal with that organisation is concluded before donating or promising to donate to a charity linked to that organisation.36 UK Anti-Bribery Practice Note at para 3.7.

As with gifts, you can also consider keeping a record of all donations or pro bono services which your firm gives to charitable organisations.37 Lexcel Toolkit at p 80. It is good practice to record the reason for deciding to make any charitable donation and the amount involved.38 Anti-Bribery Toolkit at pp 37 and 44.

Risk Assessment

After identifying the relevant corruption risks, PACT recommends conducting a risk assessment to improve the company’s ability to combat corruption.39 PACT at p 18. A sample risk assessment checklist is provided in Appendix F of PACT on how to mitigate risks in the areas of human resource, procurement, business development, accounts and inventory.40 PACT at pp 46-48.

In addition, if your law firm has offices overseas, provides legal services in certain sectors or has a business relationship with third parties, you could analyse the areas that your law firm is most exposed to corruption risks. The UK Anti-Bribery Practice Note suggests this checklist:41 UK Anti-Bribery Practice Note at para 3.3.

- Are you doing business in countries with a high risk of bribery?

- Are you doing business in a sector with a high risk of bribery?

- Do your contracts with agents and other business partners:

- state that offering or accepting bribes could lead to your terminating the contract?

- contain clear payment terms that are appropriate for the services provided?

- Have you checked whether those whom you do business with:

- have an anti-bribery policy?

- do business in countries with a high risk of bribery?

- have ever been involved in bribery?

- Have you checked the local anti-bribery laws of the countries where you do business?

Your law firm’s policy should ensure that your staff conduct appropriate due diligence in the areas that your law firm is most exposed to corruption risks. For example, more extensive due diligence should be conducted if your law firm is transacting with a party from a high-risk industry or country, as opposed to a regulated professional from a low-risk country.42 UK Anti-Bribery Practice Note at para 3.4.

The American Bar Association (ABA)’s anti-bribery policy lists a number of red flags that signal a transaction may involve bribery or corruption.43 American Bar Association, “Foreign Corrupt Practices Act and Anti-Bribery Policy” (1 November 2013)

<https://www.americanbar.org/content/dam/aba/administrative/antitrust_law/leadership/council_agendas/fall/2013fall_fcpa_antibrib.authcheckdam.pdf> (accessed 6 September 2018) (“ABA Anti-Bribery Policy”) at pp 5-6.

- Payments which are greater than normal;

- Payments to third parties outside the transaction;

- Non-standard invoices;

- Inadequately-documented transactions;

- Unusual credits granted to new customers (e.g. cash advances); or

- Counterparty rejecting or asking to modify substantially any anti-bribery provision.

3. Control and communicate

A holistic approach to prevent corruption is required as an anti-bribery and corruption policy on its own is not sufficient.44 PACT at p 20. PACT suggests that companies institute internal controls such as keeping accurate records, stipulating clear standard operating procedures and performing regular audit checks.45 PACT at p 20.

In addition, companies should provide a reporting or whistle-blowing avenue for their employees, “without fear of reprisal or reprimand if done in good faith”.46 PACT at p 21. The UK Anti-Bribery Practice Note recommends that law firms have a point of contact within the firm for staff to discuss any concerns with.47 UK Anti-Bribery Practice Note at para 3.10. The human resources department should also ensure that staff who raise genuine concerns will not be penalised or disciplined.48 UK Anti-Bribery Practice Note at para 3.11.

It is important that law firms communicate their anti-bribery and corruption policy, code of conduct, internal controls and reporting system to all employees, and if appropriate, their business partners and other stakeholders.49 PACT at p 21.

4. Track

PACT recommends regular tracking and evaluation of the company’s anti-corruption system and policy in order to assess whether improvements or modifications are required.50 PACT at p 23. Basic evaluation criteria include the following:51 PACT at p 23.

- Efficacy of the existing system to prevent corruption;

- Efficiency in keeping operation costs low; and

- Sustainability of the system to combat corruption in the long run.

Improvements or modifications may also be required if there is a company reorganisation or shifts in the business operating environment.52 PACT at p 23.

Conclusion

The PACT framework, “Pledge, Assess, Control and Communicate, Track”, offers a clear and simple structure for law firms to manage the risks of bribery and corruption. A corruption-free business will not only improve a law firm’s reputation, but also enhance its competitive edge.53 PACT at p 4.

Endnotes

| ↑1 | International Bar Association, Organisation for Economic Co-operation and Development and United Nations Office on Drugs and Crime, “Risks and threats of corruption and the legal profession: Survey 2010” <https://www.anticorruptionstrategy.org/AC_strategy_legal_profession_report.aspx> (accessed 4 September 2018) (“IBA Corruption Risks Survey”) at p 6. |

|---|---|

| ↑2 | From 95 jurisdictions. See IBA Corruption Risks Survey at p 8. |

| ↑3 | IBA Corruption Risks Survey at p 6. |

| ↑4 | IBA Corruption Risks Survey at p 6. |

| ↑5 | IBA Corruption Risks Survey at p 6. |

| ↑6 | CPIB Research Room, “Corruption in Singapore Remains Low” <https://www.cpib.gov.sg/research-room/corruption-situation-singapore> (accessed 25 October 2018). |

| ↑7 | Corrupt Practices Investigation Bureau, “PACT: A practical anti-corruption guide for businesses in Singapore” (2017) <https://www.cpib.gov.sg/sites/cpibv2/files/publication-documents/PACT%20A%20Practical%20Anti-Corruption%20Guide%20For%20Businesses%20in%20Singapore%20%282018%29.pdf> (accessed 16 October 2018). |

| ↑8 | PACT at p 13. |

| ↑9 | Amy Bell, Anti-Bribery Toolkit (Law Society Publishing, 2012) (“Anti-Bribery Toolkit”) at p 35. |

| ↑10 | PACT at p 4. |

| ↑11 | Law Society of England and Wales, “Practice Note: Bribery Act 2010” <https://www.lawsociety.org.uk/support-services/advice/practice-notes/bribery-act-2010/> (accessed 3 September 2018). |

| ↑12 | UK Anti-Bribery Practice Note at para 3.1. |

| ↑13 | PACT at p 13. |

| ↑14 | PACT at pp 12-3. |

| ↑15 | PACT at pp 41-2. |

| ↑16 | PACT at pp 16-7. |

| ↑17 | PACT at p 18. |

| ↑18 | PACT at p 18. |

| ↑19 | PACT at p 16; UK Anti-Bribery Practice Note at para 3.5. |

| ↑20 | PACT at p 16. |

| ↑21 | PACT at p 16. |

| ↑22 | PACT at p 16. |

| ↑23 | UK Anti-Bribery Practice Note at para 3.5. |

| ↑24 | UK Anti-Bribery Practice Note at para 3.5. |

| ↑25 | PACT, Appendix D at p 43; UK Anti-Bribery Practice Note at para 3.5. |

| ↑26 | Cap 241, 1993 Rev Ed. |

| ↑27 | PACT at p 16; see also PCA at s 9(1). |

| ↑28 | PACT at p 16. |

| ↑29 | UK Anti-Bribery Practice Note at para 3.5. |

| ↑30 | UK Anti-Bribery Practice Note at para 3.5. |

| ↑31 | Transparency International UK, “How to Bribe: A Typology of Bribe-Paying and How to Stop It” (January 2014) <http://www.transparency.org.uk/publications/how-to-bribe-a-typology-of-bribe-paying-and-how-to-stop-it/#.W7GiymgzaUk> (accessed 1 October 2018) at p 16. |

| ↑32 | UK Anti-Bribery Practice Note at para 3.7. |

| ↑33 | Tim Prior, Lexcel Risk Management Toolkit (Law Society Publishing, 3rd Ed, 2017) (“Lexcel Toolkit”) at p 80; UK Anti-Bribery Practice Note at 3.7. |

| ↑34 | Lexcel Toolkit at p 80; UK Bribery Practice Note at para 3.7. |

| ↑35 | Lexcel Toolkit at p 80; UK Bribery Practice Note at para 3.7. |

| ↑36 | UK Anti-Bribery Practice Note at para 3.7. |

| ↑37 | Lexcel Toolkit at p 80. |

| ↑38 | Anti-Bribery Toolkit at pp 37 and 44. |

| ↑39 | PACT at p 18. |

| ↑40 | PACT at pp 46-48. |

| ↑41 | UK Anti-Bribery Practice Note at para 3.3. |

| ↑42 | UK Anti-Bribery Practice Note at para 3.4. |

| ↑43 | American Bar Association, “Foreign Corrupt Practices Act and Anti-Bribery Policy” (1 November 2013) <https://www.americanbar.org/content/dam/aba/administrative/antitrust_law/leadership/council_agendas/fall/2013fall_fcpa_antibrib.authcheckdam.pdf> (accessed 6 September 2018) (“ABA Anti-Bribery Policy”) at pp 5-6. |

| ↑44 | PACT at p 20. |

| ↑45 | PACT at p 20. |

| ↑46 | PACT at p 21. |

| ↑47 | UK Anti-Bribery Practice Note at para 3.10. |

| ↑48 | UK Anti-Bribery Practice Note at para 3.11. |

| ↑49 | PACT at p 21. |

| ↑50 | PACT at p 23. |

| ↑51 | PACT at p 23. |

| ↑52 | PACT at p 23. |

| ↑53 | PACT at p 4. |