Should You Change Your Business Structure?

Should you change your existing business structure from sole-proprietorship or a partnership to a company? A tax professional’s angle.

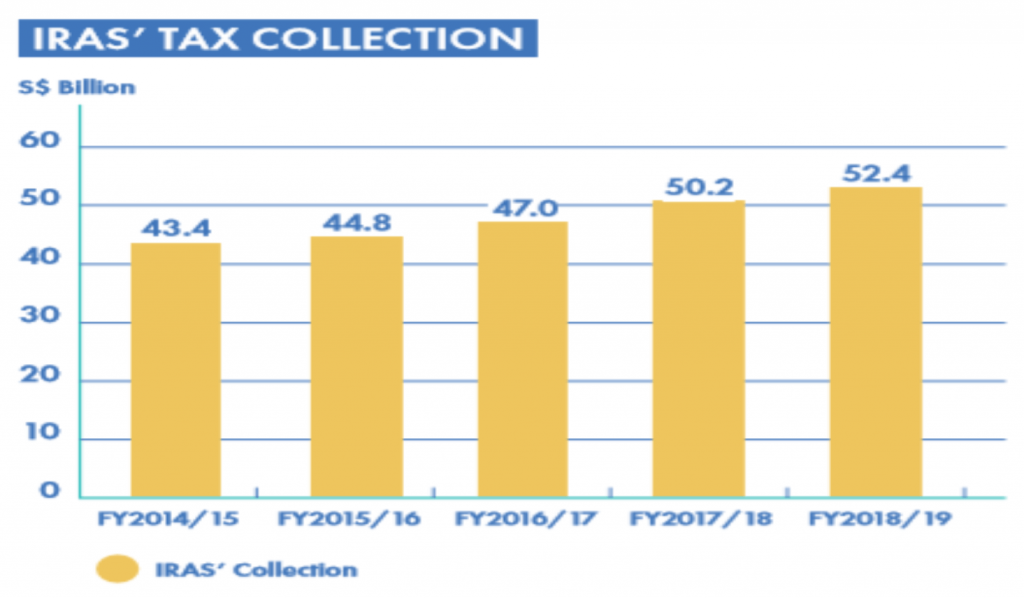

According to the Commissioner of Inland Revenue, Mr Ng Wai Choong, in the current annual report for the financial year ended 31 March 2019, Inland Revenue Authority of Singapore (the IRAS) collected S$52.4 billion in record tax revenue, 4.4 per cent higher than the previous year. Part of this revenue was through efforts of IRAS audits and investigations on 10,301 taxpayers and recoveries of approximately S$389 million. Notably, as the Singapore economy continued to grow year to year, the collection in tax revenue seemed to escalate year by year.

Source: IRAS annual report FY 2018/19

Source: IRAS annual report FY 2018/19

In an article dated 7 April 2019 contributed by Ms Lorna Tan, Invest editor and senior correspondent from Singapore Press Holdings, it was revealed that 18 per cent of the proportion of tax collected from audit adjustments over the past five years was due to arrangements that constitute tax avoidance. She opined that “Changing the business structure from sole-proprietorship/partnership to a company for the sole purpose of obtaining a tax advantage” is a type of tax avoidance arrangement and the Comptroller will make adjustments to such arrangements that are not for bona fide commercial reasons. By changing the business structure, business owners unknowingly enjoyed a lower rate of tax of 17 per cent as compared to the highest individual tax rate of 22 per cent. Apart from this, they would also enjoy partial or start-up tax exemption, and special incentives such as corporate income tax rebate.

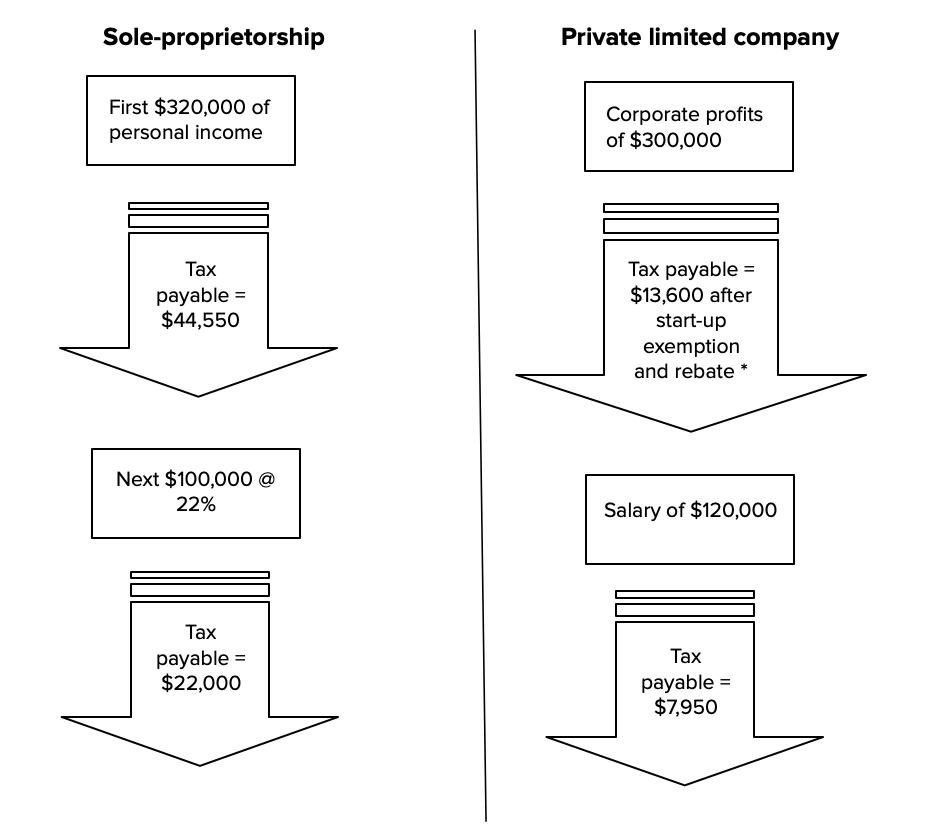

Case illustration:

Mr Robert Cai T. is a lawyer using the sole-proprietorship structure and earned net adjusted income of S$420,000 in the calendar year 2018. Assuming he conducted his business in 2018 using a private limited company and paid himself a salary of S$120,000:

* Dividends declared and paid after corporate tax is tax exempt in the hands of the shareholder

* Dividends declared and paid after corporate tax is tax exempt in the hands of the shareholder

His tax savings = $45,000 [ $44,550 + $22,000 – $13,600 – $7,950]

If obtaining a tax advantage is not the sole purpose of corporatisation, what could be bona fide commercial reasons for doing so?

Nature of business

Robert may argue that his main services are family law services for individuals. Such legal services are usually non-recurring. Given that he is not able to project his earnings in the company setup, i.e. he could be making a trade loss in the next year, a view can be taken that he is not doing this solely to obtain a tax advantage. This is in contrast to Example 5 of the IRAS e-Tax Guide “The General Anti-avoidance Provision and its Application” where the assignment of income $100,000 from Mr Z who is a sole-proprietor to a shell company H, solely for reducing the tax liability on the income which is assigned, is regarded as tax avoidance. In this example, Mr Z is able to “see” his future income due to signed legal contracts and earnings management.

Although Robert did not corporatise to capitalise on the tax advantage, should his company be profitable in the next year, he would be imprudent not to take advantage of any tax exemption or rebates made available to the private limited company structure.

Planning for succession

With the use of a private limited company structure, Robert is able to hire and groom potential legal associates into future directors without having to dilute his ownership of the company. Under the previous business form of sole-proprietorship, it is not possible to appoint the employee as a partner of the business without relinquishing some form of control and ownership of the business.

Exit strategy

Aside from the flexibility on directorship and ownership, the private limited company structure allows him to consider options of exiting the trade. Robert could build up the brand and reputation of the company, and may in the future, sell the firm through share deal or invite potential investors in as shareholders.

Legal liability issue

Most importantly, Robert is no longer personally liable for business debts and legal liabilities unlike the sole-proprietorship. The contracts are now with the private limited company as a separate legal entity.

When dealing with the IRAS, commercial reasons as stated above are only relevant to the extent that they are taken into consideration by the officer in charge. In general, one may assume that none of each of the commercial reasons stated above is in itself conclusive. This is because the Singapore Income Tax Board of Review has yet to endorse any such commercial reasons in any local tax case. Perhaps it is due to the sensitivity of the data concerned that hardly anyone would wish to contest any case with the Board of Review.

Interestingly, the Comptroller did clarify in various audits and investigations that it has no intention to interfere with the way individuals carry out their businesses, and has generally expressed that the use of a specific business model is a choice exercised by a taxpayer based on commercial considerations. However, for income tax purposes, when the Comptroller considers in the course of the audit or investigation that the income derived is not properly declared, the Comptroller will revise the assessments and bring the income to tax in the hands of the individual business owner instead of under the company.

In light of this, the key questions business owners should be asking are: is there a right moment to change the existing business structure?

Where the Sole-proprietorship is in a Net Loss Position

In any particular year where the sole-proprietorship is making losses, the next year could be the opportune time to incorporate a private limited company and transfer the business. The lack of financial data to support the IRAS computation of the “right” amount of taxes might deter further query. However, do note that the IRAS can simply aggregate the earnings and losses over a period of five years and take the average as an appropriate level of income and bring this to tax in the hands of the individual business owner.

If the intention was to put parity to the effective taxes between the two structures, an observer may ask whether it was possible to equalise the flat corporate tax rate and the individual tax tiered rates as a viable option instead. In my opinion, it would appear that as long as they are different, taxpayers would engage in tax planning to be efficient in the amount of taxes to be paid.

According to Investopedia, Berkshire Hathaway pays Warren Buffett a USD$100,000 annual salary. For the past 25 years, his salary has remained the same, but his other benefits have fluctuated with the stock market, particularly with the value of Berkshire Hathaway. All around the world, leading business people would engage in legitimate tax planning to reduce tax incidences and it is anyone’s guess, whether the IRAS is willing to deploy a similar stance with their work on such tax avoidance cases?

Paying Yourself Still Works?

Using a company model instead of a sole-proprietorship model to conduct one’s business certainly has its benefits from a remuneration perspective. For example, a sole shareholder and director of a company could decide on his or her annual remuneration based on subjective factors or key performing indicators at own preferences, incidentally reducing the total income tax payable through efficient tax planning. Strictly, if the IRAS interprets this as a form of gaming the tax rates and incentives between the structures, it will then collect more taxes. To a layman, this unreasonable interpretation could mean that the IRAS is taking a position that the remuneration of individuals working in a small or micro company has to be pegged to a certain market rate or “arm’s length rate”. Just imagine the amount of arm’s length salary a company like Berkshire Hathaway (third largest public company in the world) should be paying its chief executive Warren Buffett on an “arm’s length rate”! Next, would the IRAS start to look at legal eagles who started their boutique law corporation and paid themselves a “modest” remuneration as compared to what they were paid before as employees of a large law firm? In my view, this might constitute a double-edged sword for the IRAS – by spurring tax revenue collection while discouraging corporatization, business owners would be more likely to start a sole-proprietorship or partnership as running these structures are less costly.

Requirement to Declare Arm’s Length Remuneration

The arm’s length principle is the international standard to guide transfer pricing of goods and services. It requires a transaction with a related party to be made under comparable conditions and circumstances as a transaction with an independent party. Under the Income Tax Act section 13(16), two persons are related parties with respect to each other if:

- Either person, directly or indirectly, controls the other person; or

- Both persons are, directly or indirectly, controlled by a common person.

The Income Tax Act does not define the arm’s length principle and it shall not be applicable in the circumstances where personal remuneration for individuals working in a small or micro company is determined. In this connection, one may wonder whether the IRAS would accept an expert’s opinion on the right amount of remuneration based on benchmarking studies on similar sized companies in the same industries?

Conclusion

It was only a decade ago when the Accounting Corporate and Regulatory Authority was strongly encouraging unincorporated businesses or self-employed individuals in Singapore to corporatise. In this wave, many doctors, dentists, lawyers, accountants, consultants, commission agents, private tutors and even renovation contractors gradually moved to set-up their private limited companies. This was to protect themselves from being personally liable for business debts and other losses.

Within a short span of time, the IRAS has apparently shifted its position by adopting the view that the tax planning option of changing the business structure not with the sole purpose to obtain tax advantage as tax avoidance. Perhaps this is the right time to ditch the use of the sole-proprietorship or partnership structure, once and for all. It is no longer viable to think that one can simply transfer business from a sole-proprietorship or partnership structure to a private limited company once it becomes profitable.

It is stressful for lawyers to prepare and submit answers to audit and investigative queries raised by the IRAS. Trust me – you may have to pay a visit to your doctor arising from such undue stress unless of course, your doctor is also facing an income tax audit for changing his/her sole-proprietorship business to a private limited company. He or she can then commiserate with you on the problems you are both facing.

Notes

- IRAS annual report FY2018/19

- “Common tax-filing errors of the self-employed” published 7 April 2019

- “Warren Buffett’s Annual Salary at Berkshire Hathaway” Investopedia updated 19 November 2018

- IRAS e-Tax Guide: The General Anti-avoidance provision and its application dated 11 July 2016